Image © Adobe Images

The Pound and Australian Dollar are both outperformers in the current environment, which is flattening volatility in GBP/AUD.

The Pound to Australian Dollar exchange rate is confined to a tightening range as volatility in the pair declines, and we doubt the upcoming Reserve Bank of Australia (RBA) interest rate decision will break the deadlock.

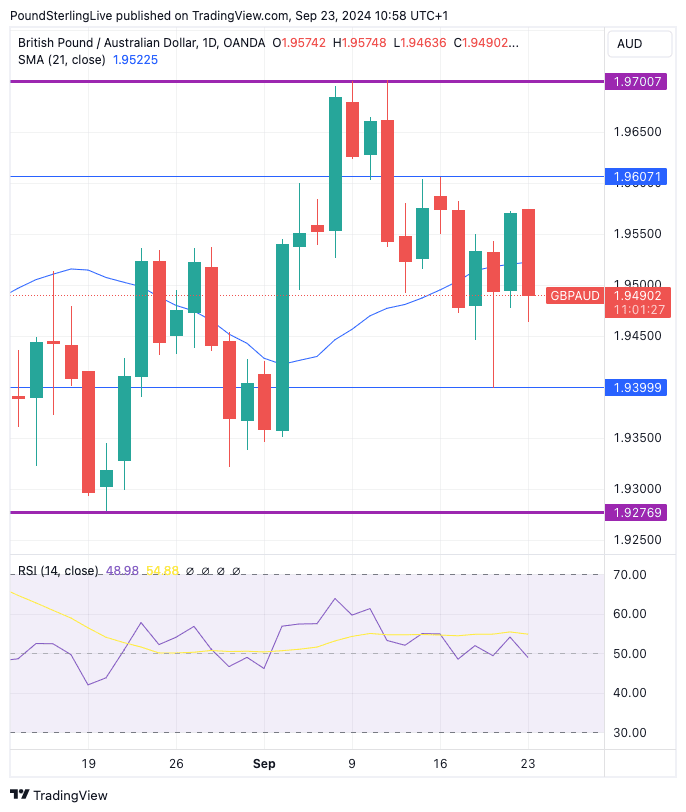

As the chart shows, the past week has seen the range shrink and consolidate around the 21-day moving average, currently at 1.9522. Our favoured approach is to suggest the 21 DMA will act as a fulcrum, with price action oscillating around it.

Above: GBP/AUD at daily intervals.

The RSI momentum index in the lower panel belies the lack of volatility as it is flat at 50, confirming a deadlock. For those with GBP/AUD payments, the current state of affairs should be welcomed as it implies risks to either the downside or upside are limited, removing some anxieties from the process.

However, those hoping for higher or lower levels will be disappointed by the lack of ambition here and will hope Tuesday's RBA decision will offer some life.

We aren't so optimistic that this will be the case, thinking that the RBA will hold interest rates and maintain an unchanged guidance that warns domestic inflation is still too high to warrant lower rates.

Australia's generous fiscal settings and relatively timid interest rate hiking cycle negate the need for imminent rate cuts, and we think Michelle Bullock and her team will continue to reflect this.

Markets see the prospect of a rate cut before year-end, but most economists still think this is a story for 2025.

This means AUD is finding support via the interest rate channel, as investors factor in a late and slow interest rate cutting cycle from the AUD.

The GBP is in a similar camp: although the UK has already seen one interest rate cut in August, last week saw the Bank of England warn against expecting an accelerated pace of cuts.

GBP and AUD both have their central banks in their corner. In addition, both tend to benefit when global stock markets are rallying, as they are doing in the wake of last week's Federal Reserve decision.

To be sure, the AUD tends to benefit more, which implies some GBP/AUD downside in a low volatility, risk-on environment.

But our reading remains one of an exchange rate that is caught in a vice and this week won't see the grip loosened.