Image © Adobe Images

Strategists at an independent financial markets research firm say they are holding onto the view the Australian Dollar has further gains in its tank.

BCA Research says there is further upside potential in the AUD following this week's Reserve Bank of Australia (RBA) decision, which was deemed 'hawkish'.

"The press release had a hawkish tone. It emphasised elevated inflation and the uncertain outlook going forward," says BCA in a post-RBA assessment.

The central bank maintained interest rates unchanged, but Governor Michelle Bullock revealed board members had discussed raising interest rates again. No discussion was held on cutting interest rates.

The Australian Dollar outperformed on the day, with markets judging the RBA would cut rates after its peers, which can offer currency support from relative interest rate yield differentials.

The central bank's basic interest rate influences the value of bond yields; higher-for-longer interest rates should ensure Aussie yields stay elevated while yields elsewhere fall as other central banks cut rates. This can attract foreign exchange inflows that support the currency.

Due to the "relative hawkishness of the RBA", BCA's Global Fixed Income and Foreign Exchange strategists believe there is "still potential for upside in bond yields and the AUD".

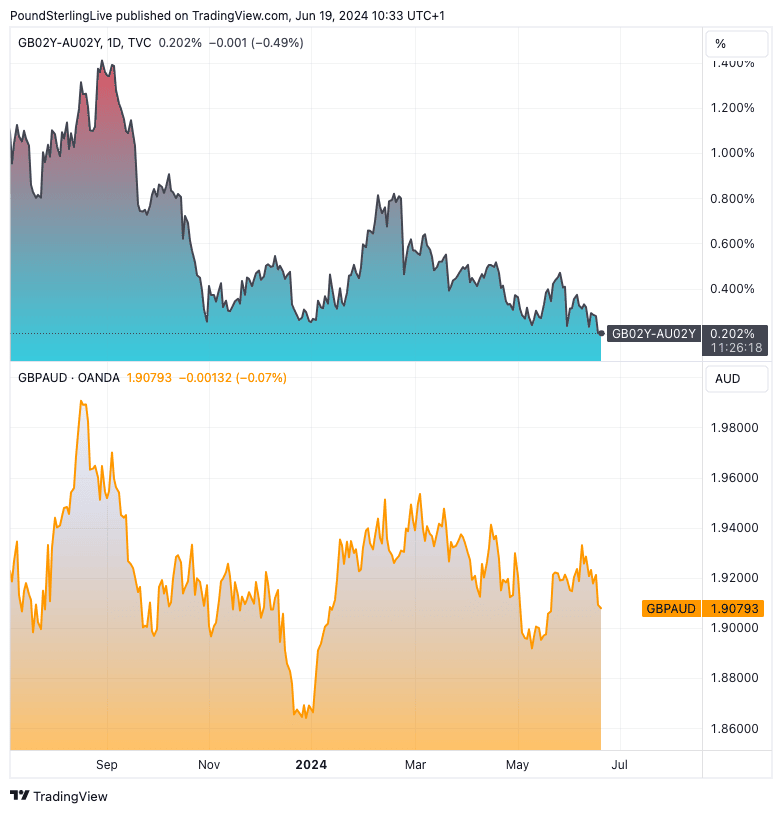

Above: GBP/AUD (in lower pane) tends to track the difference in yields between UK and Aus (top pane, showing UK 2y-AU2y yield).

BCA strategist Chester Ntonifor has been bullish AUD since March, explaining at the time that the RBA would not be cutting interest rates as soon as markets expected owing to stubborn inflation.

At the time, Ntonifor pointed out that markets expected "the RBA will cut interest rates soon."

His assessment has proven correct, with market expectations retreating substantially. In fact, rates might only be cut for the first time in 2025.

"Maintain long AUD trades," said Ntonifor.