Image © Adobe Images

The Pound to Australian Dollar exchange rate has fallen for two weeks in succession and further losses are likely as markets consider the potential for another Australian interest rate hike. But we could see a limited bout of GBP/AUD strength in the early parts of this week.

GBP/AUD is in a technical downtrend that we would ultimately expect to continue in the coming days and weeks as investors contemplate the potential for another interest rate rise at the Reserve Bank of Australia (RBA).

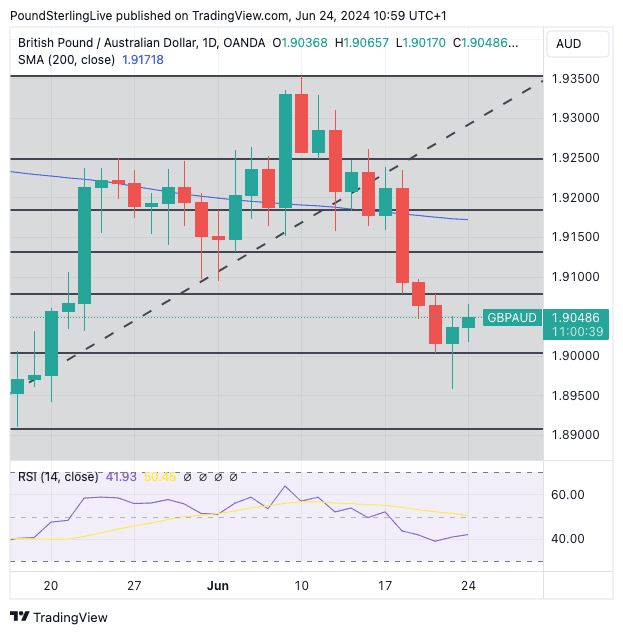

That said, the exchange rate can retrace some of its recent losses in the next few days, with a rise to 1.9077 (a 61.8% Fibonacci retracement of the May-June rally) possible.

We think any rise in the exchange rate is more akin to a consolidation than a major recovery, and we would prepare for a retest of 1.8908, the May low, towards the end of this week or at some point next week.

This could happen later this week if U.S. PCE inflation data soften more than expected, boosting global risk sentiment and spurring demand for the Australian dollar.

Above: GBP/AUD at daily intervals. The RSI in the lower panel has turned higher, hinting at some near-term upside consolidation. Track GBP/AUD with your own alerts, find out more here.

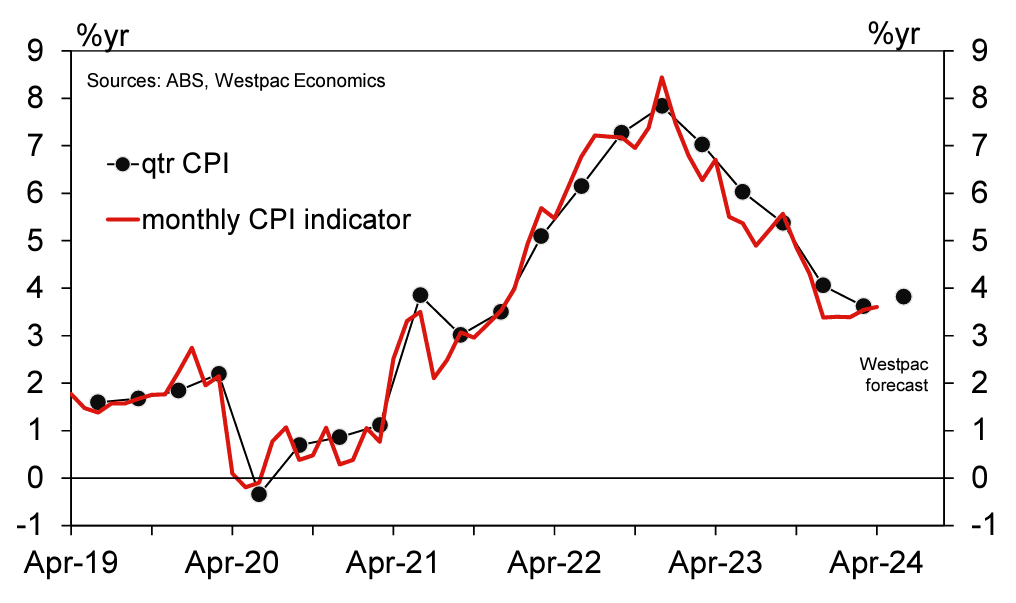

There is some domestic risk in the form of Wednesday's monthly inflation reading. The market forecasts a reading of 3.8% year-on-year, and the Australian Dollar will likely move higher if the figure is exceeded, as this could push back on interest rate cut expectations.

In fact, it could boost the odds that the Reserve Bank of Australia raises interest rates again.

Image courtesy of Westpac.

The Aussie Dollar has been one of the best-performing major currencies of the past two months, helped by expectations the RBA will likely be the last of the G10 central banks to cut interest rates. Should expectations for a rate hike increase, then the interest rate setup becomes even more supportive of AUD.

"Australia’s monthly CPI data risk showing further acceleration in inflation as more services data populates the monthly data. The monthly CPI data will act as a warm-up for the more important Q2 data in about a month’s time and could raise expectations for a strong number that could trigger an RBA rate hike in August," says David Forrester, Senior FX Strategist, at Crédit Agricole.

Last week the Australian Dollar strengthened after the Reserve Bank of Australia's June policy update proved more 'hawkish' than the market expected.

The RBA left interest rates unchanged but expressed new concerns about the persistence of inflation, hinting that it is a little less inclined than before to consider cutting interest rates. This week's release will provide more light on just how persistent the country's inflation is proving.

"The RBA performed a hawkish hold last week and significantly reduced investor speculation that the central bank is going to cut rates this year which even led to the Australian rates market pricing in some risk of a rate hike," says Forrester.

The Bank of England, meanwhile, looks set to cut interest rates in August, creating a clear contrast in central bank policy that will weigh on GBP/AUD.

For GBP/AUD to recover, we would likely need to see global equity markets sell off (this tends to weigh on AUD) and/or markets become more confident the RBA won't raise interest rates again.

We don't see this happening anytime soon.