According to new research, the Pound Sterling can rise further against the Canadian Dollar in the coming days and weeks.

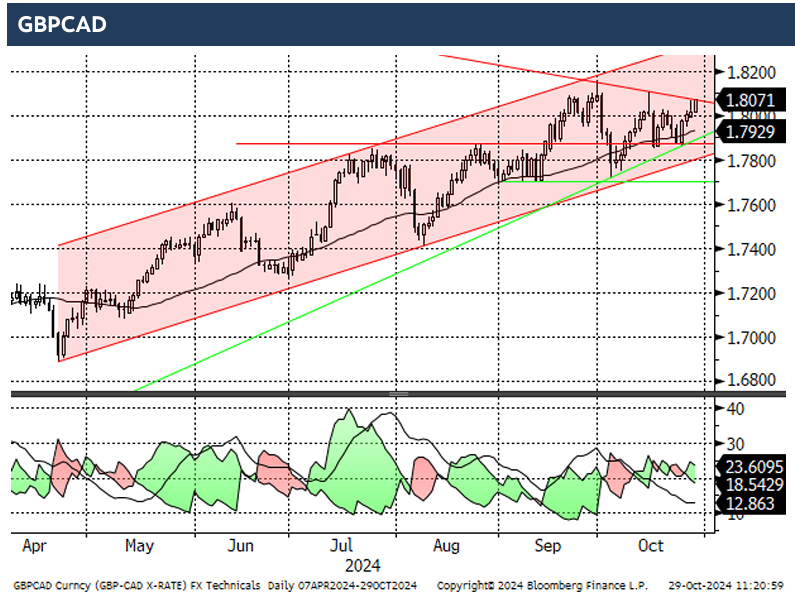

"GBPCAD continues to hold within the broader parameters of its long-term bull channel. It also continues to experience a contraction in its short-term trading range," says Shaun Osborne, Chief FX Strategist at Scotiabank.

Osborne's call comes ahead of the U.S. presidential election, which will be the marquee event for foreign exchange markets this week and into year-end.

The outcome could determine whether the U.S. Dollar rallies into year-end (under a Trump win) or slides back to levels last seen at the start of October.

It was in October that markets started to see rising odds of a Trump win, meaning a Kamala Harris victory could see the subsequent premium built up in financial markets unwind.

However, analysis from Crédit Agricole shows that the Canadian Dollar will potentially be the least reactive to the election.

"The 2016 and 2020 experiences showed that the CAD could be the least impacted, with the smallest spot changes two months down the road and the most benign increases in volatility," says Crédit Agricole.

If CAD shows limited sensitivity to this week's election, then GBP/CAD could resume the 2024 trend of appreciation.

"The developing symmetrical triangle is a bull pennant pattern, in effect. It tilts broader directional risks to the topside and a resumption of the bull trend—eventually," says Osborne.

He explains that a push above 1.8070 "should see the GBP resume its track higher and push on to 1.82/1.83 in the short run."