Image © Adobe Images

The Canadian economy's close ties with its southern neighbour could mean its currency is set to outperform rivals.

The Canadian Dollar could experience a spell of outperformance as the global financial order realigns for a second Donald Trump presidency.

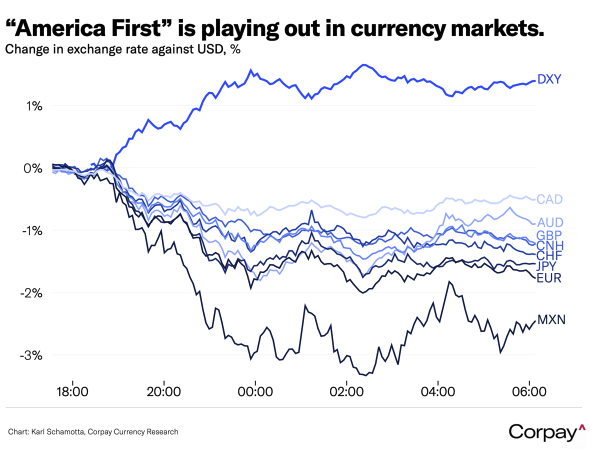

The CAD showed early signs of being a winner of the realignment by advancing against all peers after it was confirmed Trump easily won the vote and his Republican Party are set to control Congress.

"CAD is outperforming on the G10 crosses given the Trump trade," says Noah Buffam, an analyst at CIBC.

The GBP/CAD exchange rate dipped 0.36% to 1.7928 on the day the election results were announced, EUR/CAD was down 1.04% yesterday. Against the Dollar, the losses were less severe than elsewhere with USD/CAD's decline limited to 1.3879.

The market judges that Canada's close proximity to the U.S. will prove beneficial in helping Trump's policies inject fresh impetus into the economy.

"Given the spillover of fiscal stimulus expectations to Canadian growth, and the lower risk of tariffs against Canada, we could be in for a period of CAD outperformance on the crosses," says Buffam.

The crosses refer to non-USD exchange rates.

Strategists at CIBC think the Canadian Dollar will advance against the Australian Dollar, given that the Aussie is tipped to be exposed to any Chinese slowdown that might result from Trump's enactment of stringent import tariffs.

"We especially like short AUD/CAD as a play on increased China tariff risks, and a stronger USD, combined with a relatively neutral beta to risk sentiment," says Buffam.