Image copyright European Central Bank.

Wall Street investment bank Goldman Sachs has lowered its forecasts for the Pound to Euro exchange rate.

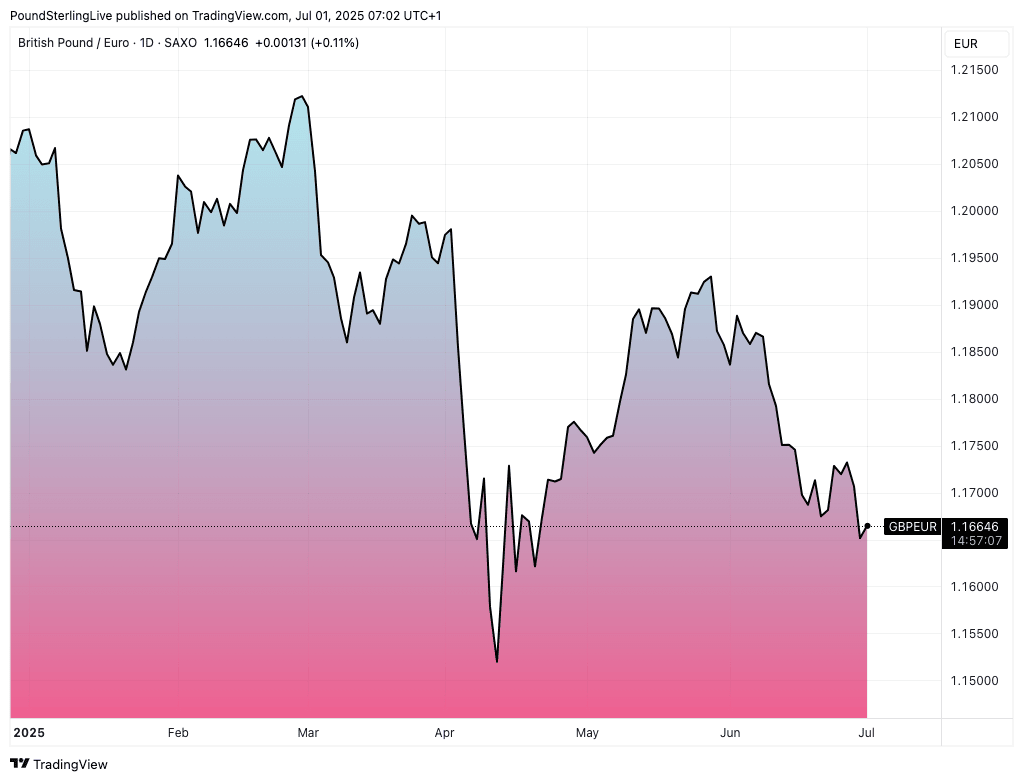

At one point this year, analysts predicted GBP/EUR would rise above 1.20, peaking as high as 1.22, as the UK economy continued to outperform and the Bank of England approached interest rate cuts with caution.

However, "in recent months, we have grown less constructive on Sterling’s prospects on European crosses," says Goldman Sachs.

The mid-year forecast pack shows a notable cut in expectations that means instead of following a rising path, GBP/EUR's trajectory slopes lower.

Goldman Sachs' forecasts are closely watched by the market and can act as a rational reference point for those with impending GBP/EUR payments to consider.

These new point forecasts can be viewed as part of Pound Sterling Live PAY's exclusive download.

Expectations for a lower GBP/EUR profile are based on a combination of a softer UK economic outlook and strong demand for Euro-based assets as the investors consider a world in which the U.S. is no longer a default for the majority of an investor's portfolio.

The slowing UK economy will invite more interest rate cuts from the Bank of England than the market is currently pricing into Sterling's value, which is important in a scenario where central bank interest rate settings start to play an increasingly important role.

Above: GBP/EUR has lost value already this year.

At the same time, economists at Goldman Sachs have reapraised the profile of the Euro, given it is proving to be a leading alternative of a rotation out of U.S. assets in the Trump 2.0 era.

The EUR/USD exchange rate could experience the same supportive forces as it did back in 2017, when "a strong equity inflow into the Euro area helped drive a rally in EUR/USD to as high as 1.25."

With GBP/USD not expected to keep pace with EUR/USD, the inevitable consequence is GBP/EUR sagging.

"In the current environment, we expect those inflows to come via a steady shift in new asset allocations away from the U.S. and toward Europe, supported both by uncertainties around the prospects for U.S. asset returns, but also by the improved position of European assets as a clear alternative," says the bank.

These new point forecasts for GBP/EUR are available as part of Pound Sterling Live PAY's exclusive download, which can be found here.