Image © Adobe Images

The pound has risen in relief on news the government won't need to issue as much new debt as some feared.

The Treasury said it would require £4.6BN of extra gilt sales in 2025-26; "this was at the low end of the range," say economists at Lloyds Bank in a post-budget reaction.

Lloyds says the market took some comfort from this figure that could have been higher and threatened to unsettle UK debt markets.

The government borrows by issuing gilts - UK government bonds - to lenders in order to fill the gap between its spending and what it earns in taxes. Overload the market, and the cost of servicing that debt spirals and destabilises UK assets, like the pound.

"With GBP advancing versus USD and EUR it looks like the exchange rate is also taking the view that the limited overall increase in the government's financing need is more of a relief than the slightly unfavourable backloaded profile to the fiscal consolidation," says a post-budget reaction from Lloyds Bank.

Lloyds says markets are reflecting relief that the overall increase in the government's cash need through to 2029-30 has only risen by a modest £8BN from a starting base of £656BN.

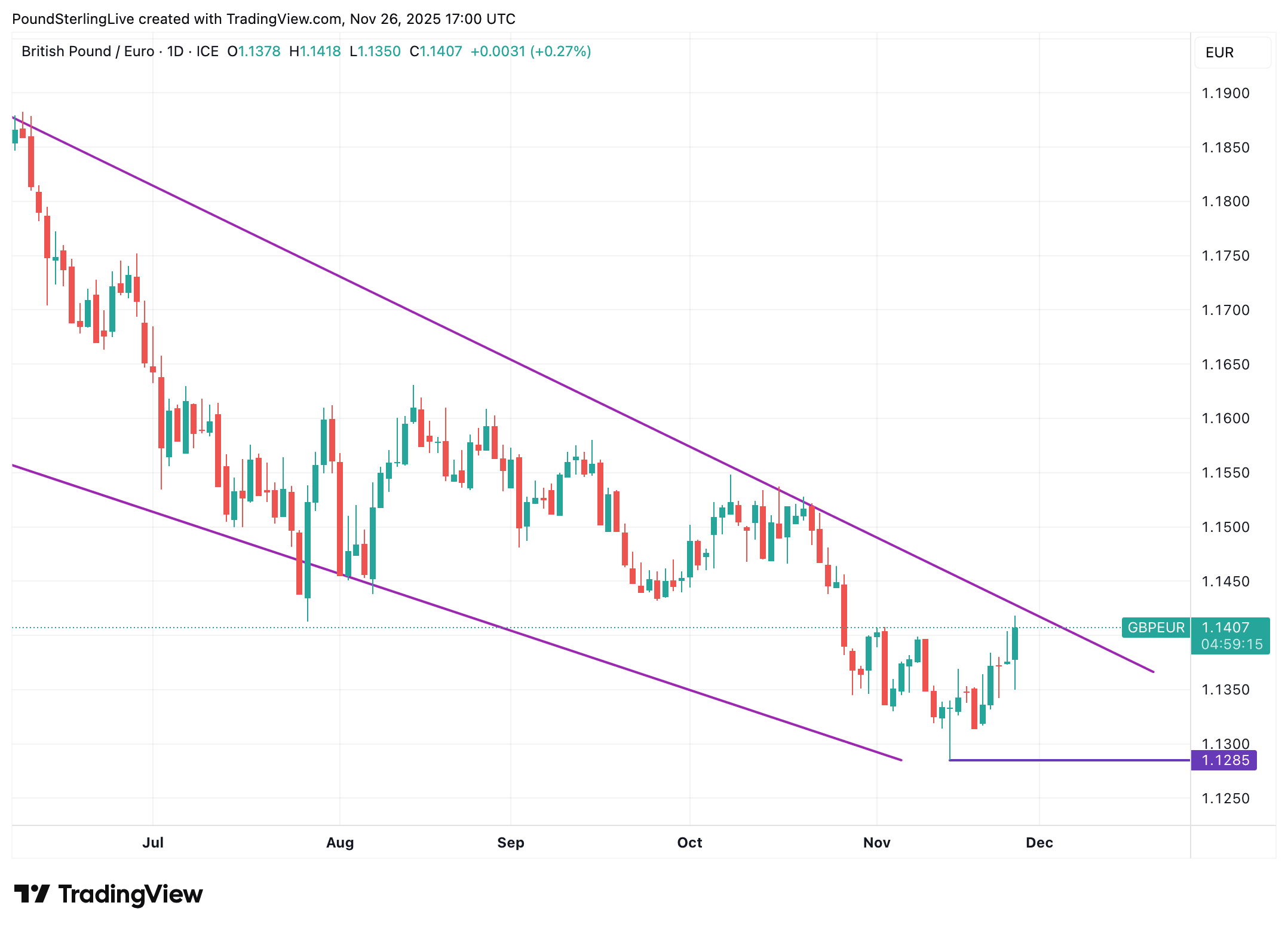

Above: Although GBP is higher, it remains caught in a downward trend against the EUR. For now, strength is judged temporary.

Markets are jittery over the trajectory of the UK's borrowing, and a big debt issuance figure resulting from today's budget risked destabilising gilts and the pound.

Sterling has steadily fallen in apprehension of Wednesday's announcement, and the lack of surprises on debt issuance will prove supportive.

The pound to euro rate's initial response has one of relief, going 0.25% higher on the day to reach 1.14.

The pound initially fell in response to the budget being leaked ahead of time, but then started gaining ground when it was announced that the Treasury would restore a sizeable headroom in its finances with £26.1BN in new taxes.

That headroom - or breathing space - is particularly important to lenders as it minimises any negative shocks wrought on the public finances by unexpected events.

"A larger-than-expected £22bn headroom figure - mistakenly released ahead of time - helped soften investor scrutiny and lifted tolerance for policies that might otherwise have sparked volatility," says Antonio Ruggiero, FX & Macro Strategist at Convera.

He adds that today’s UK Budget delivered a raft of back-loaded tax measures that may soothe markets in the short term. "Sterling is firmer and gilt yields have edged lower."

The relief establishes the conditions for a year-end GBP relief-style rally.

However, looking into 2026 shows conditions remain challenging.

"The Budget leans on an unusually complex mix of nearly 90 individual tax fixes, making the £26bn revenue target harder to model and potentially less reliable," says Ruggiero.

He notes that while sterling is firmer and gilt yields have edged lower, this stability may prove deceptive.

"As markets fully digest the scale of back-loading and complexity, pressure is likely to re-emerge at the long end of the curve, with sterling vulnerable to renewed weakness."