Image © Adobe Images

The Pound to Euro exchange rate has stabilised after unraveling much of its second quarter advance in the early days of August and could be likely to trade buyantly within a rough 1.1639 to 1.1711 range this week.

GBP/EUR steadied above 1.16 and around the middle of its first-quarter range last week as stock markets rebounded from early August’s losses, and low-yielding funding currencies ebbed from recent highs.

Sterling remained one of the poorer performing G10 currencies, however, even as GBP/EUR stabilised. But better risk appetite in global markets and a comparatively higher yield offering are among the factors that could see the pair testing the top side of an estimated 1.1639 to 1.1711 range in the days ahead.

“There is a busy schedule of economic data releases in the week ahead including: The latest UK labour market report (Tues), CPI report for July (Wed) and GDP report for Q2 (Thurs),” MUFG analysts said on Friday.

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of November uptrend and selected moving averages indicating prospective areas of support.

“The BoE will be looking for further evidence that services inflation and wage growth is slowing to open the door for further rate cuts this year,” they added in a Friday research briefing.

The author’s model suggests upside momentum is likely to fade in the 1.1711 but this assumption could prove erroneous if the pending deluge of UK economic data offers Sterling some reason for the cheer.

The most favourable combination would include signs of ongoing resilience in the labour market on Tuesday, a renewed decline for UK inflation including the services component on Wednesday, and a further extension of the first quarter’s dead cat bounce in GDP when data for June are released on Thursday.

Consensus suggests the unemployment rate rose 10 basis points to 4.5% in June, and that inflation crept back up to 2.3% in July, from 2% previously. Meanwhile, GDP is seen rising 0.1% for June on Thursday.

“While headline inflation has been at 2% for 2 consecutive months, the BoE itself forecasts a rise to 2.7% by the end of the year before a return to target in 2026,” BCA Research strategists said.

“At the same time, wage growth and services inflation remain sticky, sitting at 5% and 5.7% respectively, presenting upside risks to the inflation forecast,” they added in a Friday research briefing.

The consensus outlook for inflation and GDP growth is bullish for Sterling because, rightly or wrongly, it could lead the market to expect that interest rates will remain higher for longer than otherwise.

This dynamic could act as a catalyst for GBP/EUR to return toward fair value, which is estimated to be around 1.1916; close to its recent highs. The author’s fair value model uses inflation, interest rates and the cross-currency differentials between both to estimate where currencies should trade as inflation rises and falls.

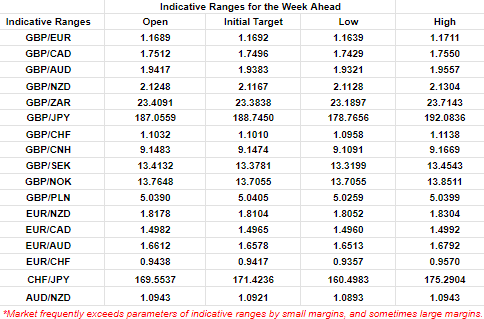

Above: Quantitative model estimates of possible ranges for the week. Source: Pound Sterling Live.