Image © Adobe Images

Euro exchange rates fell after the Eurozone's PMI survey for November revealed a deterioration in conditions, hastening the need for support from the European Central Bank (ECB).

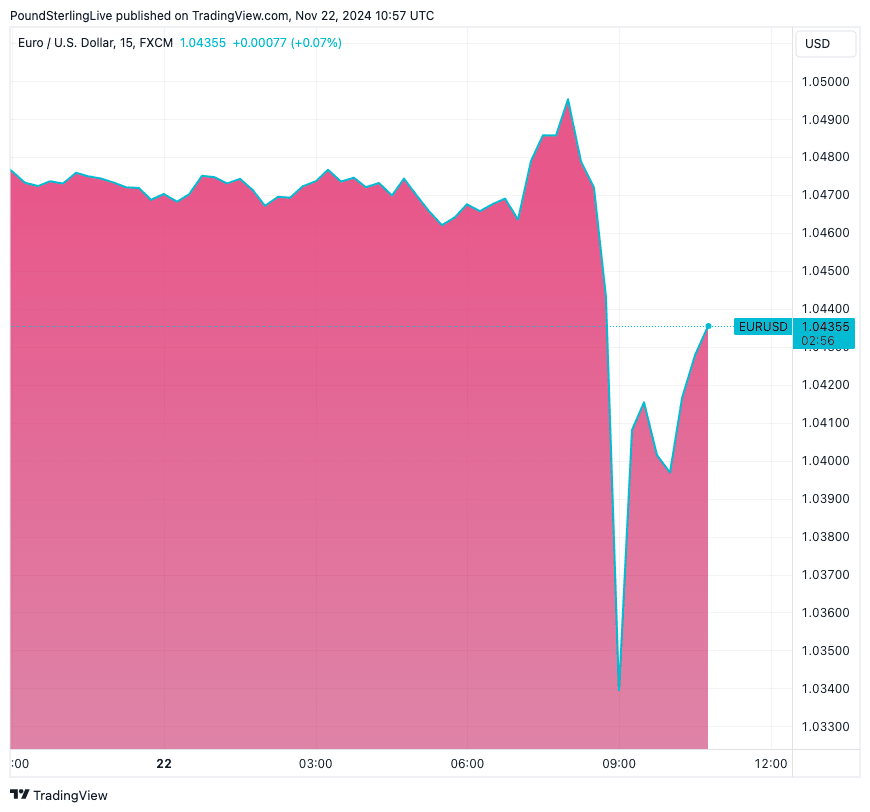

The Euro to Dollar exchange rate slumped to below 1.04 for the first time in two years, putting it on course for parity after the S&P Global Eurozone composite PMI fell to 48.1 in November from 50 in October.

The market was expecting another reading of 50. A reading below 50 signals contraction for the Eurozone's private sector.

The Euro to Pound exchange rate fell a third of a per cent to 0.8297, giving a Pound to Euro conversion of 1.2050.

"Things could hardly have turned out much worse," says Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank. "The eurozone's manufacturing sector is sinking deeper into recession, and now the services sector is starting to struggle after two months of marginal growth."

Looking at the subcomponents, the Eurozone manufacturing PMI remains in contractionary territory at 45.2, down from 46. But the deterioration is most noticeable in the services sector, with the PMI falling to 49.2 from 51.6, defying expectations for a slight improvement to 51.8.

de la Rubia says the economic deterioration "is no surprise really, given the political mess in the biggest eurozone economies lately."

Separate French and German PMI data confirms the bloc's two largest economies are the focus of weakness.

"Both economies are weighed down by domestic political uncertainties, with the composite PMI in France falling even more sharply than in Germany in November. In the rest of the euro area, however, business activity continued to expand, albeit at a moderate pace," says Felix Schmidt, an economist at Berenberg Bank.

de la Rubia explains that France's government is on shaky ground, and Germany's heading for early elections. "Throw in the election of Donald Trump as US president, and it is no wonder the economy is facing challenges. Businesses are just navigating by sight."

The S&P Global survey revealed confidence in the outlook for output dropped to the lowest for just over a year.

Companies continued to face challenges securing new orders, which decreased for the sixth month running and at a solid pace.

With new business and backlogs of work falling, firms also scaled back workforce numbers, noted the report.

This will alarm the ECB's policymakers, who are now likely to cut interest rates by 50 basis points in December.

The economy is deteriorating more broadly now, and the ECB will judge that hastening the pace of its interest rate cuts is needed to help businesses and consumers.

This development would have a negative impact on the Euro, particularly against the Dollar and Pound, where interest rates are set to remain elevated for longer.

"We could well see EUR/USD test parity once more," says Harry Woolman, Associate at Validus Risk Management. "The euro continues to trend lower against most major currency pairs, already surpassing September 2023 lows against the dollar in the immediate aftermath of the release."