Chancellor Rachel Reeves. Picture by Kirsty O'Connor / Treasury

Demand for permanent staff at UK businesses plunged following Chancellor Rachel Reeves' tax raid on employment. This is a potential red flag against British Pound strength in 2025.

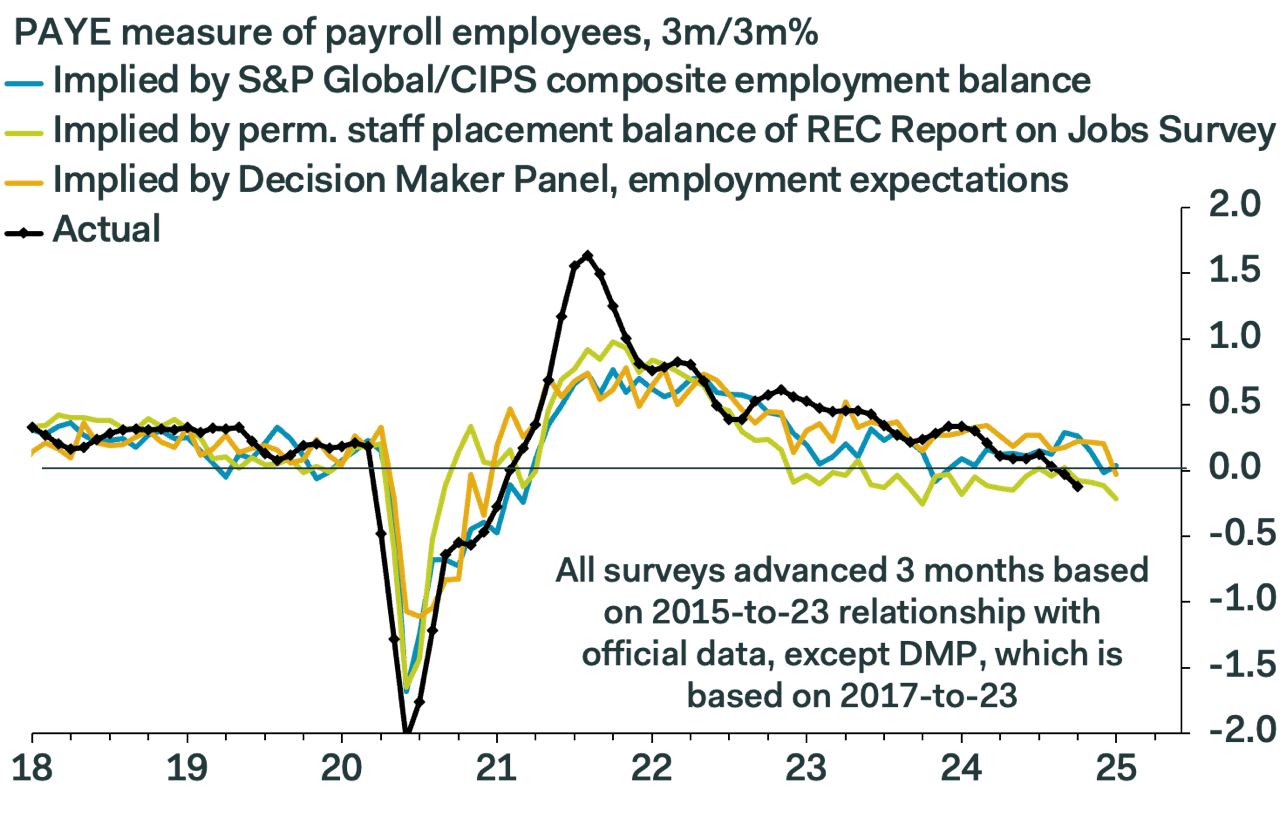

The Recruitment & Employment Confederation (REC) says its monthly permanent staff placements index fell to 40.7 in November from 44.1 in October, placing it well below its 54.2 average in the second half of the 2010s.

This represents the largest month-to-month drop since November 2023, taking the balance to a 15-month low.

"The REC survey showed a sharp deterioration in the labour market in November as firms scaled back hiring following the Chancellor's payroll tax hike in the Budget," says Elliott Jordan-Doak, Senior UK Economist at Pantheon Macroeconomics.

Image courtesy of Pantheon Macroeconomics.

At the same time, the number of people looking for a new role rose: the permanent staff availability index rose to 59.8 in November from 59.1 in October, still well above its 38.0 average in the second half of the 2010s.

This suggests that the demand for jobs is high, but the supply of jobs is falling, inevitably resulting in declining wage increases.

This could mean the Bank of England will find itself with more scope to cut interest rates in 2025 as it judges falling wages as a deflationary input in the inflation matrix.

Such an outcome would pose a significant headwind to the Pound, which has risen amid expectations that the Bank will be one of the slowest rate cutters amongst its peers.

"With growth outcomes having weakened in recent months, its possible that the jobs and wage outlook weakens in the months ahead, enabling Governor Bailey’s recent forecast of 100 bps in cut in 2025 to be realised. We like EUR/GBP upside through the December BoE and ECB meetings, says Noah Buffam, an analyst at CIBC Markets.

The REC's wage gauge shows wage pressures are falling. The permanent staff salaries index rose to 52.6 in November from 52.5 in October. However, it averaged 60.0 in the second half of the 2010s.

The temporary staff salaries index fell to 51.2 in November from 51.5 in October.

"There’s no doubt job growth has slowed to a crawl after the Budget," says Jordan-Doak.

But it's not all downhill for the Pound in 2025.

Pantheon Macroeconomics thinks there is a good chance that the permanent staff placements balance will rise from current levels as demand is boosted next year by the Chancellor’s Budget measures, offsetting firms' immediate reaction to the tax hikes.

Although Reeves raised employment taxes, she also announced a notable increase in government spending, which can support the economy in 2025.

"The recently announced fiscal expansion of c.1% of GDP ought to support demand in the near term and, all else equal, implies an even slower cutting cycle by the MPC," says a weekly FX note from Barclays.

Should the labour market hold up amidst solid demand, then Pound Sterling outperformance can extend into a third consecutive year.

"Heading into the new year, we have made some adjustments to our GBP profile to highlight our conviction that further upside is likely over the medium-term. There are risks, as always, to any forecast profile - deteriorating risk sentiment, higher volatility. But for now, we do not think that the UK Budget is an imminent threat," says Kamal Sharma, FX analyst at Bank of America.

Analysts at Barclays say although there has been some softening in UK data - mainly surveys in the wake of the budget - "we remain fairly constructive on the pound."

"Structural improvements for the UK supply side from closer EU-UK ties remain in scope, particularly given likely US policies from the incoming administration. Relatedly, the UK is likely less exposed to direct tariff risks than the eurozone," says Barclays.

In the aggregate, analysts at the UK bank expect sustained UK economic outperformance versus an already ailing eurozone and a grind for EURGBP towards 0.80. (This translates into a Pound to Euro conversion of 1.25).