Image © Adobe Images

Pound Sterling strength is offering euro buyers their best exchange rates in more than two and a half years.

The Pound to Euro exchange rate rallied to a new 2024 high at 1.2110 on Tuesday as a well-established uptrend extended ahead of Thursday's European Central Bank (ECB) policy decision.

This means those buying euros are seeing rates of around 1.2050-1.2070 as spreads or fees at the major providers are taken into account.

The move in GBP/EUR appears to be driven by EUR weakness, as we see EUR/USD come under some pressure too. This suggests investors are 'front running' the ECB decision, due Thursday midday.

The ECB is expected to cut interest rates by 25 basis points, although some in the market think it could take a bolder approach and cut by 50bp. The latter move would prompt a further weakening in the Euro.

To cut by 50bp would suggest that ECB decision-makers fear that the Eurozone's economy is struggling and needs assistance, which lower interest rates can provide.

However, declining rates in the Eurozone contrast with those in the UK, where rates are expected to fall at a slower pace.

Sterling trades "stronger against both the dollar and the euro, on expectations for the Bank of England not to cut rates next week, and to lower them only moderately next year," says Asmara Jamaleh, an economist at Intesa Sanpaolo.

The UK economy is expected to remain resilient, while the Eurozone is said to be more exposed to potential trade tariffs from Donald Trump's incoming administration.

"Structural improvements for the UK supply side from closer EU-UK ties remain in scope, particularly given likely U.S. policies from the incoming administration. Relatedly, the UK is likely less exposed to direct tariff risks than the eurozone," says a note from FX analysts at Barclays.

This can encourage a flow of capital from places such as the Eurozone into the UK, bidding up the Pound against the Euro.

"Heading into the new year, we have made some adjustments to our GBP profile to highlight our conviction that further upside is likely over the medium-term. There are risks, as always, to any forecast profile - deteriorating risk sentiment, higher volatility. But for now, we do not think that the UK Budget is an imminent threat," says Kamal Sharma, FX analyst at Bank of America.

However, there are some reasons to cautious too:

1) This might be the market 'front running' the ECB decision. Often, traders look to trade a likely event before it actually happens to maximise returns.

This means there could be little movement on Thursday when the ECB makes its decision. It also means the Euro could strengthen as investors "sell the rumour, buy the fact".

If the ECB cuts by 25bp and maintains that it will be reactive to the data, the Euro will rally as the more extreme scenario of a 50bp cut fails to materialise.

A number of bank analysts we follow think it is still to early to panic and that the ECB will cut by 25bp.

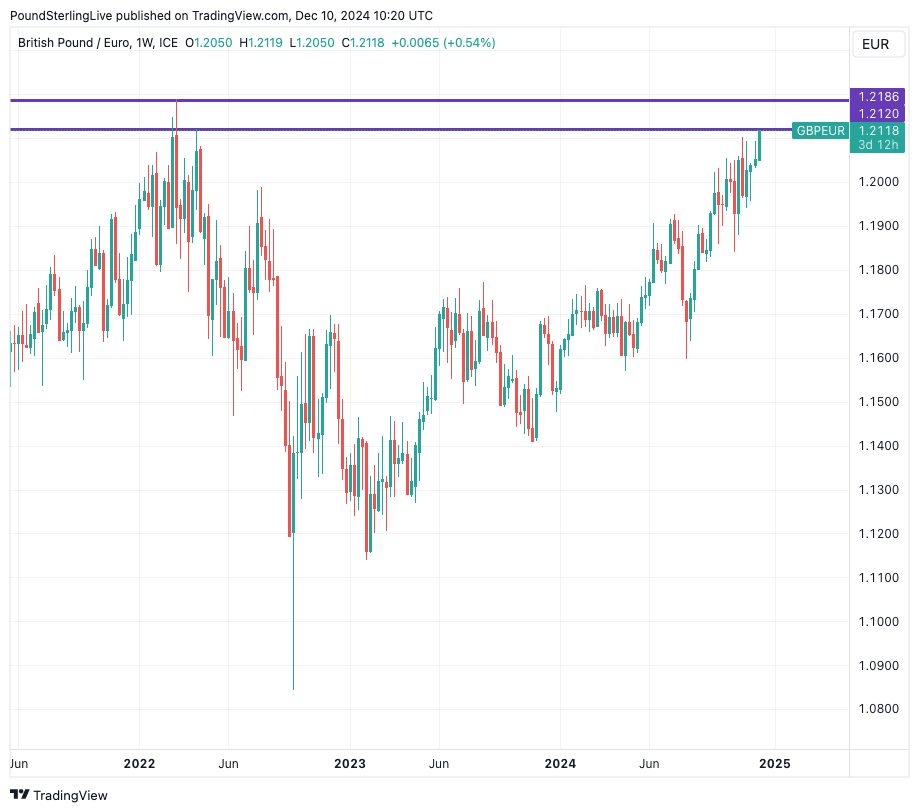

2) The exchange rate is approaching what could be a significant technical barrier. The weekly chart of GBP/EUR below shows that the pair failed in 2022.

The horizontal line marks the upper limit of the post-Brexit range, and traders might be inclined to book profit and/or actively sell Pound Sterling around here in anticipation of another failure.

However, a break of this resistance opens the door to 1.2188 and then 1.25.

Analysts at Barclays forecast a grind lower for EUR/GBP towards 0.80 in 2025, which translates into a GBP/EUR conversion of 1.25.

3) This morning Pound Sterling Live published a report looking at a potential headwind to the Pound in 2025: the labour market.

The REC is the latest organisation to warn of potential job losses from Rachel Reeves' job taxing budget. The REC reports permanent staff placements index fell to 40.7 in November from 44.1 in October, placing it well below its 54.2 average in the second half of the 2010s.

This represents the largest month-to-month drop since November 2023, taking the balance to a 15-month low.

"The REC survey showed a sharp deterioration in the labour market in November as firms scaled back hiring following the Chancellor's payroll tax hike in the Budget," says Elliott Jordan-Doak, Senior UK Economist at Pantheon Macroeconomics.

This could mean the Bank of England will find itself with more scope to cut interest rates in 2025 as it judges falling wages as a deflationary input in the inflation matrix.

Such an outcome would pose a significant headwind to the Pound, which has risen amid expectations that the Bank will be one of the slowest rate cutters amongst its peers.