Above: File image of Huw Pill. Image © Global Utmaning, Lasse Skog. Modified from original, reproduced under CC licensing, non-commercial.

The Pound-to-Euro exchange rate still looks poised for further gains.

Something that would assist the Pound higher against the Euro would be a slowdown in the pace at which the Bank of England cuts interest rates going forward.

And this is exactly something the Bank's Chief Economist, Huw Pill, thinks is the right course of action to take.

In a speech delivered on Tuesday, Pill said he thinks the Bank is going too fast and explained why he voted to keep interest rates unchanged in May as a result.

"While the underlying disinflation process remains intact, the quarterly pace of 25bp Bank Rate cuts seen since last summer is too rapid given the inflation outlook," says Pill.

The Pound rose in the wake of the Bank's May interest rate cut, with markets judging that there was no consensus behind the need to accelerate the pace of interest rate cuts. In short, the meeting was more 'hawkish' than expected, which typically translates into an upside currency reaction.

This is because FX markets are highly sensitive to the differences in interest rate policy between the world's big central banks which have entered a cutting cycle. Currencies belonging to central banks that opt to cut at a slower pace than rivals find their currencies bid.

Pill says his preference is for a "cautious and gradual" pace for the withdrawal of policy restrictions.

This caution, he says, derives from concerns that structural changes in price and wage setting behaviour have increased the intrinsic persistence of the UK inflation process.

The GBP/EUR exchange rate rose in the wake of May's policy decision after investors expressed surprise that Pill and fellow Monetary Policy Committee member Katherine Mann voted to keep interest rates unchanged, dissenting from the majority who wanted rates cut. This was a surprise, as there was even speculation that the Bank would deliver a deeper 50bp cut.

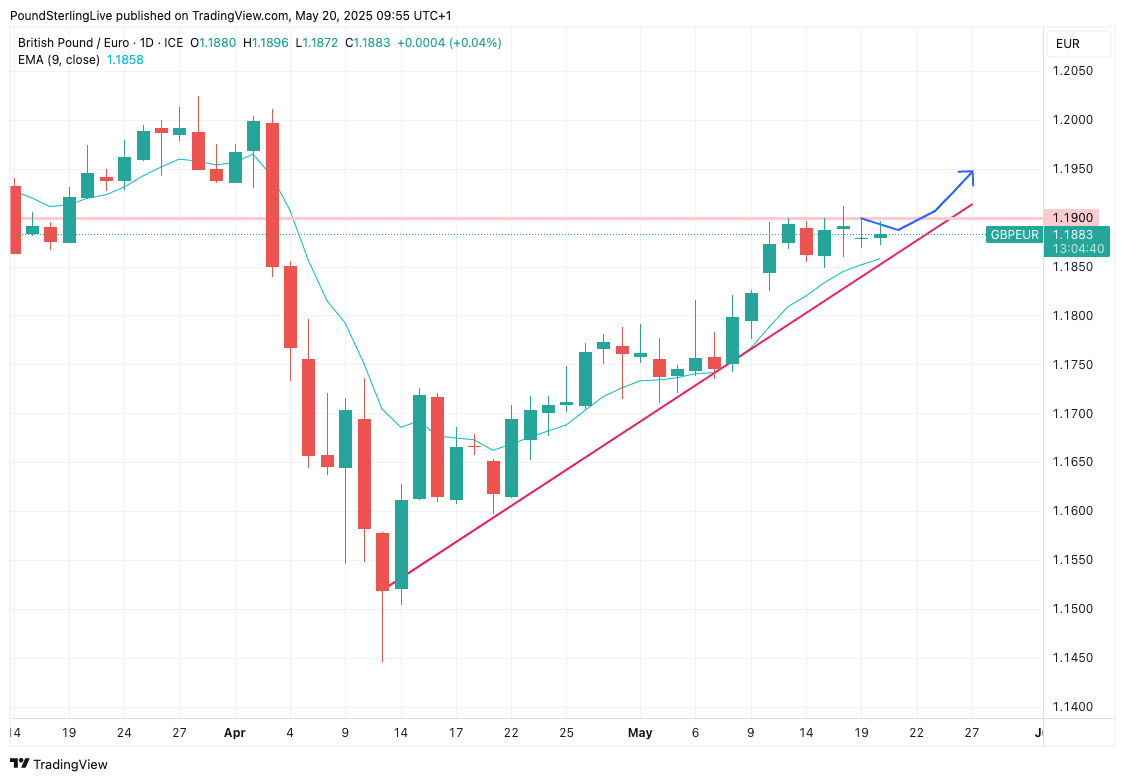

Above: GBP/EUR at daily intervals. The chart shows our annotated expectation for future moves made in our Week Ahead Forecast on Monday. So far, so good.

The Pound stands to gain should the market reduce expectations for further rate cuts at the Bank.

Pill's arguments advocate for this, as he warns that "as long as disinflation back to target is not complete, maintenance of some restriction will still be required."

To be sure, he doesn't call for an end to the process, but rather a slowdown.

"Fundamentally we think inflation will prove more persistent than the Committee does, because inflation expectations are somewhat deanchored, which could prevent the MPC cutting twice more this year," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics.

Andrew Wishart, Senior UK Economist at Berenberg, is more 'hawkish' in his assessments, saying that the Bank has cut for the last time this year.

"Survey data suggest that aggregate demand is strong enough for companies to pass on much of the increase in wages (up 5.9% yoy in March) and payroll tax to customers in the form of higher prices, which would prevent core inflation slowing from its current pace of 3.4%," says Wishart.

This echoes Pill's concerns about price-setting behaviour at firms contributing to elevated inflationary pressures.

Berenberg notes that the MPC voted for a cut in May on the basis that "underlying domestic disinflation was progressing as expected".

"We question whether this assumption will hold by the time we arrive at the next live meeting in August," says Wishart.

Indeed, Pill alludes to recent developments as potentially justifying further caution:

"Since the MPC’s policy decision, we have seen significant further developments. There has been more news on the trade side, not least the US-UK trade agreement announced in Washington DC shortly after the publication of the Bank Rate decision."

He also notes markets appear to have fully reversed their post-'liberation day' declines.

Put together, these developments suggest global and trade risks have been reduced meaningfully.

For a cautious rate setter, this suggests a reason to remain cautious about cutting too quickly and risk stoking inflationary pressures.