File image of Chancellor Rachel Reeves. Picture by Kirsty O'Connor / Treasury.

Pound Sterling can't shake pre-budget Uncertainty.

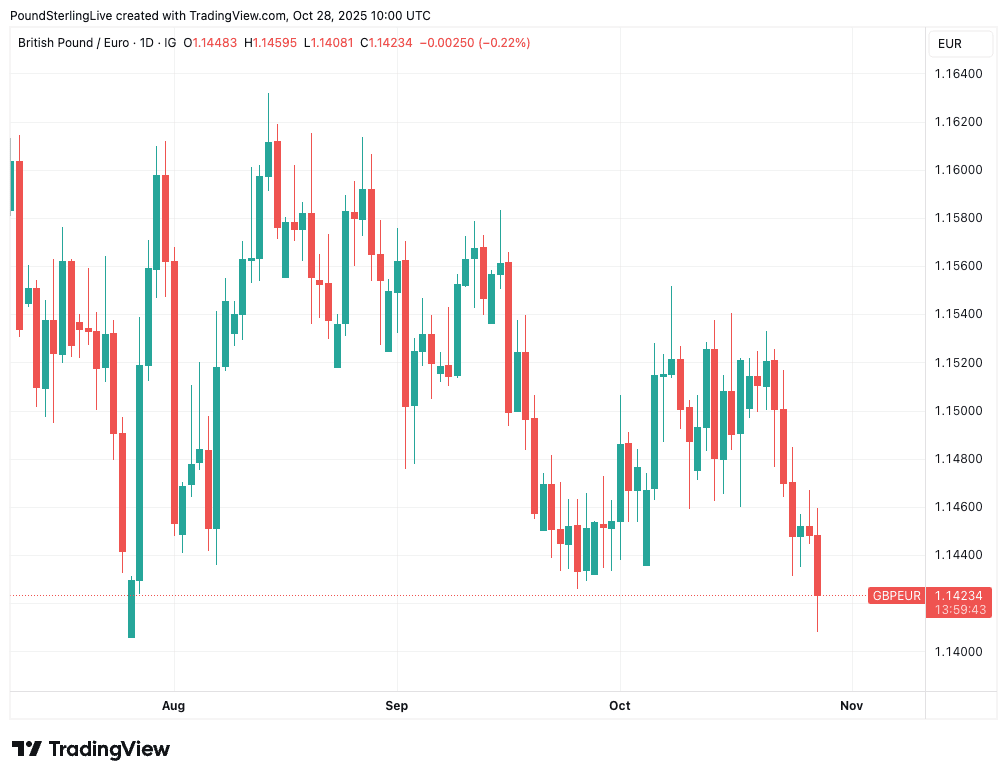

The pound has fallen to its lowest level in two months against the euro on the day the scale of the 'black hole' in the UK's public finances is made clearer.

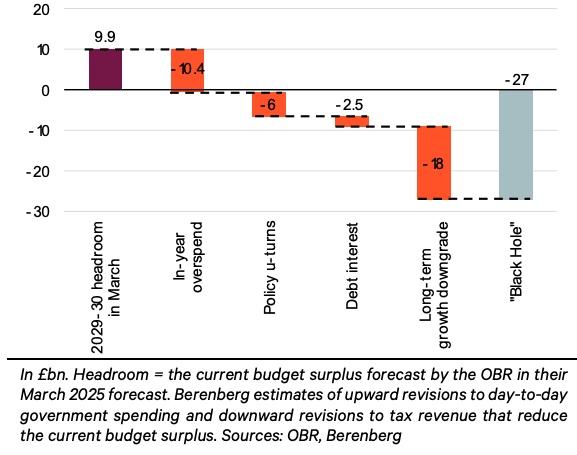

According to reports, that hole will be £31BN, owing to a single downgrade in the all-important Office for Budget Responsibility forecasts.

That downgrade pertains to the UK's long-term productivity, which the OBR has perennially overestimated. According to the FT, which spoke to someone "familiar" with the matter, the markdown to productivity is reported to be 0.3ppt, deeper than the consensus was expecting.

Using IFS calculations, that 0.3ppt downgrade translates into a £21BN miss on the budget projections. Then, we need to add the minimum £10BN 'headroom' that all Chancellors like to build to protect against future shocks.

So, before we have taken everything else into account, the Chancellor must find at least £31BN.

Strategists at Nomura, the global investment bank, reacted to the FT article, saying, "UK fiscal risks remain a challenge."

They reiterate a long EUR/GBP trade that profits on further GBP weakness against EUR.

A calculation by Berenberg shows how the budget black hole has emerged.

The government won't cut welfare spending, meaning it must raise taxes. Given it won't touch the big earners of VAT, income tax and corporation tax, the risks of a policy mistake and a poor market reaction are high.

(The Q4 pound-euro consensus forecast is out: the big investment banks have cut their projections. According to the 3M consensus median and mean, the exchange rate is now undervalued, find out more).

This creates an aura of uncertainty that is weighing on the pound.

"We believe the British pound can lag," says a recent monthly forecast note from Wells Fargo. "Contentious budget negotiations and somewhat elevated local political risk should also restrain overall pound performance."

At the time of writing, the GBP/EUR trades at 1.1425, the lowest level since July 27, making for a two-month low.

The GBP/USD is at 1.3320, down 1.12% on the day and extending the monthly decline to nearly 1.0%.

In January, the pound and UK bonds slumped in tandem, a rare occurrence, signalling growing worries about the UK's economic growth and debt sustainability outlook.

Another such episode occurred in July, when the government abandoned planned welfare cuts.

The risk is that the coming budget doesn't pass the credibility test and another bout of weakness in UK financial assets ensues.