Prime Minister Keir Starmer. Picture by Simon Dawson / No 10 Downing Street.

Although financial markets are positioned for further gains by the Pound, business leaders have sent the first clear warning signal that the outlook is dimming.

UK business leaders turned more cautious in August as the new government signalled a raft of unsavoury policy measures that included reforms to workers' rights and taxes that would target investment.

The Institute of Directors survey of UK business leaders revealed the sharpest decline in business investment intentions since the beginning of the pandemic lockdowns. Headcount expectations also dropped 14 points, from +24 to +10 – this was likewise the sharpest fall since the first pandemic lockdown.

"The newsflow in recent weeks on employment rights and Autumn tax rises has dented confidence in the environment for business in the UK," says Anna Leach, Chief Economist at the Institute of Directors.

For the Pound, the risk is that the deterioration in sentiment amongst business leaders hits investment intentions and is reflected in official economic data releases in the coming months.

"Structural issues and fiscal headwinds suggest that the best of the recovery is over," says David Alexander Meier, an analyst at Julius Baer, in a monthly forecast update on the British Pound's prospects.

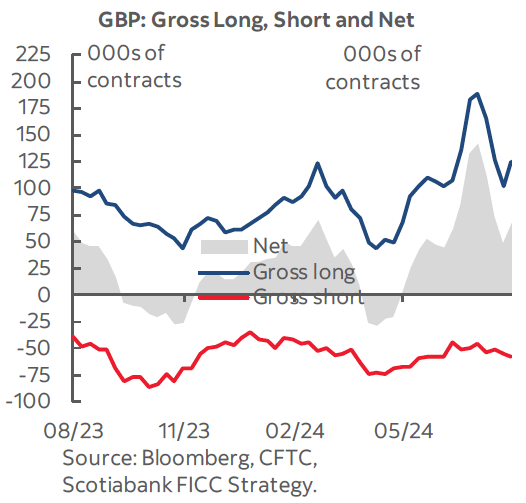

The developments come amidst increased speculative interest in the Pound, with new positioning data showing traders have rebuilt their 'long' position on the Pound, signalling the community thinks further gains are possible.

There are numerous variables that drive a currency, and many continue to be supportive of the Pound, but the sudden turn in sentiment amongst UK decision-makers sends a message that this optimism can deteriorate.

Above: Positioning data shows traders are optimistic on the Pound. Image: Scotiabank.

Prime Minister Keir Starmer last week prepared the UK for a tax-hiking budget this October, warning it "is going to be painful" and "those with the broadest shoulders should bear the heavier burden."

Speculation in the press suggests fuel duty rises and wealth taxes are being floated by the government, while a Capital Gains Tax (CGT) increase is almost certain.

The government has also revealed it will introduce a raft of measures that will boost workers' rights. For businesses, the fear is this will raise the cost of hiring staff while also potentially lowering staff productivity.

The IoD survey shows business investment in staff and machinery, a mainstay of economic growth, is at risk of deteriorating as a result of Labour's plans. "It's disappointing to see last month’s welcome uptick in business leader confidence snuffed out over the summer. It is notable that the sharpest drops in our economic measures are in investment and headcount expectations," says Leach.

Economists say the negative messaging from the new government risks hurting sentiment and talking the UK into a downturn. "The economic outlook depends upon the fundamentals, policy choices & confidence. Lose confidence and it deters people from spending or firms from investing. Realism is needed but get the balance right. Don't talk yourself into a downturn," says Gerard Lyons, Chief Economic Strategist at Netwealth.

The risk for the Pound is that the sentiment swing seen amongst businesses is reflected in other domestic surveys due for release in September. In particular, we will be watching the PMI survey for clearer signs of deterioration.

Any undershoot in confidence risks spoiling a narrative that the UK economy is set to continue outperforming that of the Eurozone, which could result in a deeper pullback in the Pound to Euro exchange rate in the coming weeks.