Above: Georgette Boele, ABN AMRO. File Photo. Image Courtesy of ABN AMRO.

The British Pound has more fuel in its tank to drive outperformance against the Euro and Dollar over the medium term.

This is according to a new foreign exchange forecast and analysis from ABN AMRO, the investment bank, which has upgraded its Sterling forecast profile for the coming months and year.

"We expect sterling to outperform the dollar and the euro in our forecast horizon," says Georgette Boele, Senior FX Strategist at ABN AMRO.

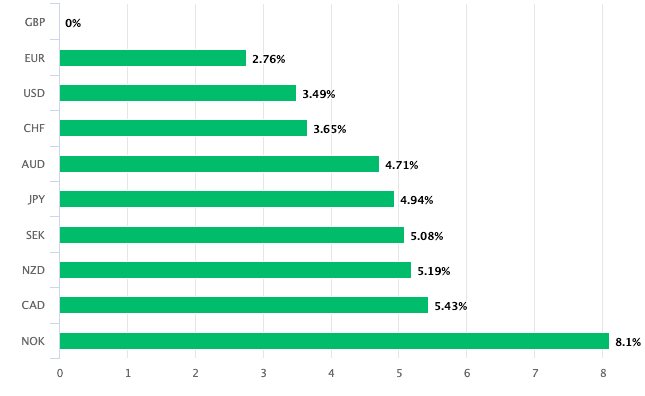

The Pound is 2024's best-performing currency, with the Pound to Euro exchange rate registering a 2.83% advance and the Pound to Dollar exchange rate a 3.47% gain. The new figures show the advance can exceed 1.20 and 1.33 for the respective pairs.

The outperformance is primarily thanks to the elevated base interest rate at the Bank of England following a series of interest rate rises.

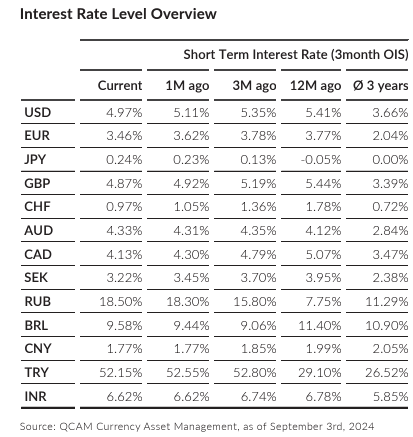

This leaves UK interest rates offering attractive returns to overseas investors: the UK's 3-month overnight index swap (OIS) rate is the second highest in the G10 at 4.87%, with the U.S. at 4.97%. But economists say the UK's rate will soon exceed that of the U.S. as a series of Federal Reserve interest rate cuts look set to weigh on U.S. lending rates into year-end.

The Bank of England has already cut interest rates once, but the current market understanding is that it will lower rates slower than its peers, which a host of analysts say will offer the Pound support. "Incoming data suggests stubbornly high underlying inflationary pressure, and sticky wage growth – which poses upside risks to medium-term inflation – is likely to keep rate cuts at a more gradual pace than for the ECB and Fed, even into next year," says Boele.

ABN AMRO expects only one additional 25bp rate cut in 2024, and four rate cuts (total 100bp) in 2025, with Bank Rate falling to 3.5% by end-2025.

Image courtesy of QCAM Currency Asset Management.

We reported yesterday that a new analysis from the British Chambers of Commerce thinks inflation will remain above the Bank's 2.0% target for the next three years, meaning the Bank will only cut rates in small increments of just 10 basis points.

As a result of the monetary policy outlook, "we expect sterling to outperform the dollar and the euro in our forecast horizon," says Boele.

Risks in the outlook include the budget announcement on 30 October. Analysts warn that the new Labour government's tax rises and relentlessly negative tone on the economy will risk business investment and slow economic growth.

GBP maintains its crown as 2024's best performing major currency.

"Early indications are that there will be a bigger fiscal tightening than previously expected. This could weigh on growth later in 2025, causing the BoE to increase the pace of rate cuts. More rate cuts will weigh on sterling," says Boele.

ABN AMRO has a Euro to Pound forecast of 0.83 from year-end 2024 through Q1, before falling to 0.82 by Q2. The forecast target rises back to 0.83 by Q3 2025. This gives a Pound to Euro forecast of 1.2050, 1.22 and 1.2050.

The previous forecast profile for these respective points was 0.84, 0.85, 0.85 and 0.84 (1.19, 1.1760, 1.1760 and 1.19.

The Pound to Dollar forecast is lifted to 1.32, 1.34, 1.36 and 1.38 from 1.27, 1.29, 1.30 and 1.31.