Image © Adobe Images

One of the UK's biggest mortgage lenders says UK house prices have risen at their fastest pace in nearly two years, which analysts say is further evidence of a constructive macroeconomic backdrop for the Pound.

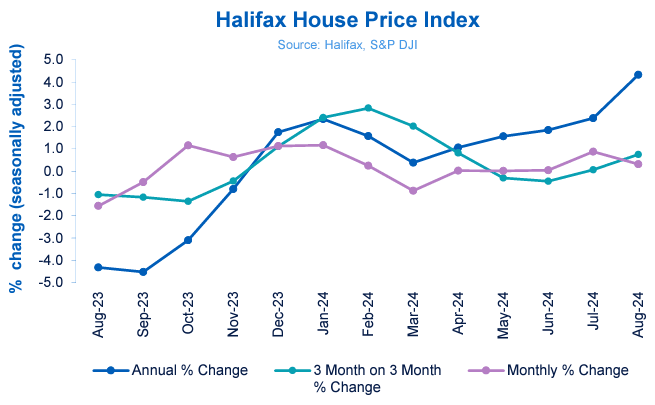

Halifax said the average house value increased by 4.3% in August to £292,505, just £1,000 shy of the record high set in June 2022.

The findings provide additional evidence of a robust UK economy and will underscore expectations that the Bank of England will leave interest rates unchanged when it meets later this month.

In fact, strength in the housing sector will provide evidence that the rise in interest rates is being absorbed by households and that lower rates risk over-stimulating the economy and boosting inflation.

"The pound's movements today follow an unexpected surge in Halifax House Price Index which posted the fastest annual growth in over a year and a half. This data, from a sector typically known for its weakness, may provide the Bank of England with greater confidence in maintaining its relatively gradual approach to rate cuts," says Samer Hasn, Senior Market Analyst at XS.com.

The Pound is 2024's best performing major currency as a result of the UK's elevated interest rates relative to its G10 peer countries.

The UK's 3-month overnight index swap (OIS) rate is the second highest in the G10 at 4.87%, with the U.S. at 4.97%. But economists say the UK's rate will soon exceed that of the U.S. as a series of Federal Reserve interest rate cuts weigh on U.S. rates into year-end.

Analysts say the ongoing support that comes via the interest rate channel can keep the Pound supported.

"We expect only one additional 25bp rate cut in 2024, and four rate cuts (total 100bp) in 2025, with Bank Rate falling to 3.5% by end-2025. As a result, we expect sterling to outperform the dollar and the euro in our forecast horizon," says Georgette Boele, Senior FX Strategist at ABN AMRO, announcing a fresh set of upgrades to her forecasts for the Pound.

Halifax says the recent rise in house prices follows a largely positive summer for the UK housing market.

"Prospective homebuyers are feeling more confident thanks to easing interest rates. That optimism is reflected in the latest mortgage approval figures, now at their highest level in almost two years," says Amanda Bryden, Head of Mortgages at Halifax.

Halifax thinks market activity can pick up further and sees the possibility of further interest rate reductions to come, which should mean house prices continue their modest growth through the remainder of this year.

Money markets show investors think the Bank of England will cut interest rates once more in 2024, but a new analysis from the British Chambers of Commerce says it will be constrained by inflation that will stay above the 2.0% forecast horizon for the next three years.

As a result, the BCC says the Bank could cut at 10 basis point increments in the future, with the first such cut coming before the end of the year, which will take Bank Rate to 4.9%.

"The Bank is expected to adopt a more cautious approach and make a series of 0.1pp cuts, bringing the interest rate to 4.3% by the end of 2025 and falling to 3.8% by the end of 2026," says the BCC.

This would represent a materially hawkish development for markets that will underpin the Pound's outlook.