Image © Adobe Images

Geopolitics sends the New Zealand Dollar sharply lower.

The Pound to New Zealand Dollar exchange rate (GBP/NZD) is forecast to register further gains in the coming days amidst a deterioration in investor morale.

The cause is not hard to find: the U.S. bombed Iran this weekend, so Iran must do something in response to save face. What it does is the question mark that will create enough uncertainty to keep stocks and commodities under pressure, as well as currencies that struggle under such a backdrop.

Of course, the Kiwi is usually at the forefront of any risk-off selloffs, and this is confirmed by current weakness.

"Developments in the Middle East will continue to be a strong driver of the Antipodean currencies," says David Forrester, FX Strategist at Crédit Agricole. "The NZD is a significant energy importer and will continue to underperform the AUD while higher oil prices last."

Although oil prices spiked in initial Monday trade, gains were soon pared, leaving them relatively near last week's levels, as shipping activity in the crucial Strait of Hormuz continues unimpeded. This comes after reports from Sunday suggested Iran is considering closing the Strait as a possible reaction.

This would disrupt a trade route on which about a fifth of the world's oil exports depend. The problem for Iran is that key allies such as China also rely on this route.

So, the markets think Iran simply has too much to lose if it draws its 'Trump' card at this stage.

Even with a worst-case outcome being avoided, lingering tensions should provide enough sauce to juice GBP/NZD higher in the coming days, and we could see a break above 2.2709 transpire.

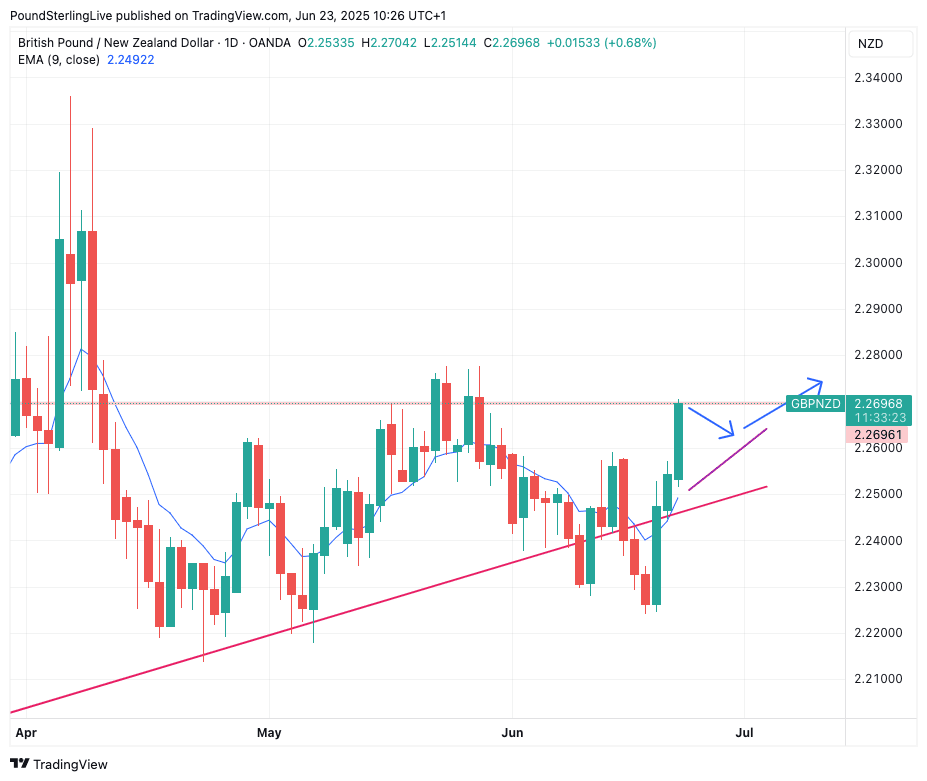

However, a look at the chart shows that the current rally leaves the exchange rate cut adrift from the nine-day exponential moving average:

Above: GBP/NZD at daily intervals.

The chart shows that GBP/NZD tends to keep in touch with the nine-day EMA, and the Week Ahead Forecast model does tend to favour mean-reverting actions from any divergence away from this line.

Given this, some near-term retracement is possible, ahead of a continuation.

Last week, we opined that the GBP/NZD was in the process of breaking down, as it had ducked below the rising trend line. However, subsequent price action could suggest this to have been a false break, and that a continuation of that trend therefore becomes possible.