Image credit: Lux Tonnerre. Sourced: Flickr. Licensing conditions: CC 2.0.

The Pound is under pressure against the New Zealand Dollar, but is still ultimately pointed higher.

The Pound to New Zealand Dollar exchange rate (GBP/NZD) is retreating from a technical resistance level and could test 2.2415 or lower in the coming days, particularly if the positive investor sentiment we are seeing at the start of the week continues.

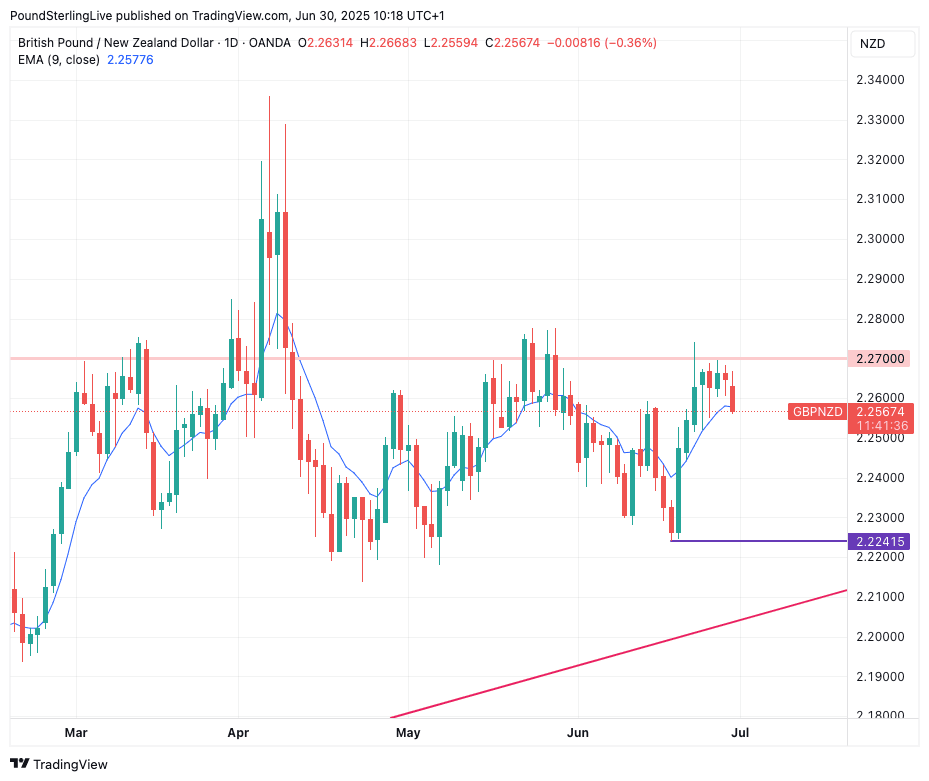

Looking at the charts, there is a layer of graphical resistance located roughly around the 2.27 region, through which the GBP/NZD was unable to successfully progress on multiple occasions last week:

A look at the daily chart shows scope for a GBP/NZD pullback.

The subsequent pullback we are seeing on Monday is consistent with that layer remaining intact and Pound Sterling 'bulls' licking their wounds.

To be sure, they will try again, particularly given that the overall trend remains higher, even if the market is in a bit of flux at the minute.

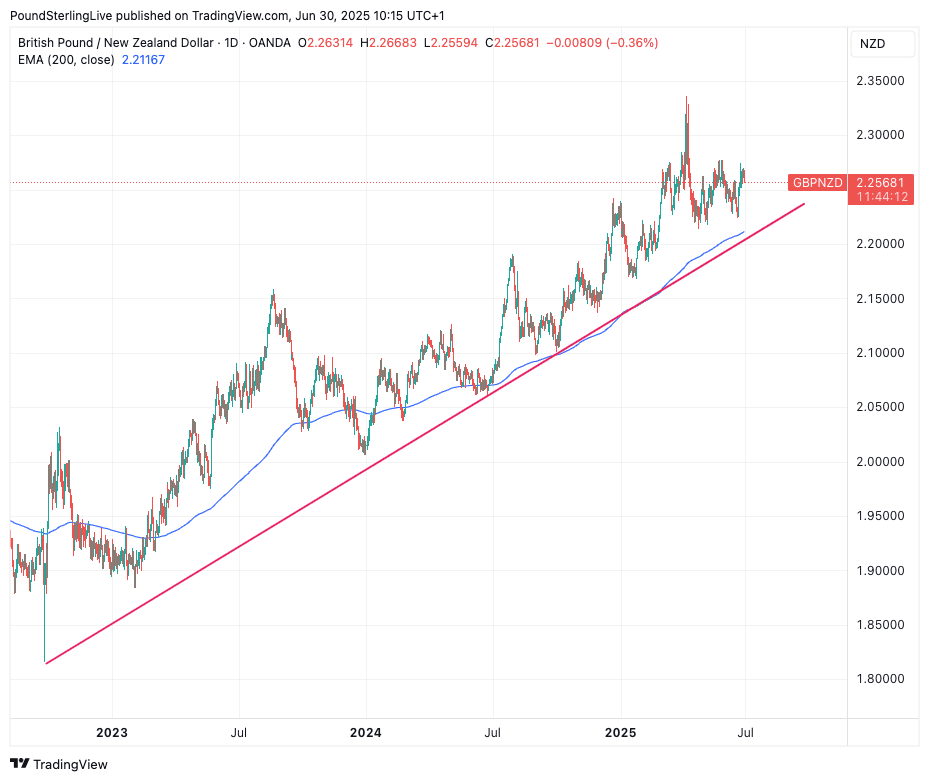

Zooming out a bit, and we see the bigger trend.

That uptrend is indicated by the red line in the chart, and it goes all the way back to September 2022. Interestingly, the trend line is also roughly where the 200-day Exponential Moving Average is located. Our rule book says that when a market is above this line it is in a longer term uptrend, and when below in a downtrend.

So these are the big lines we watch over a longer-term period.

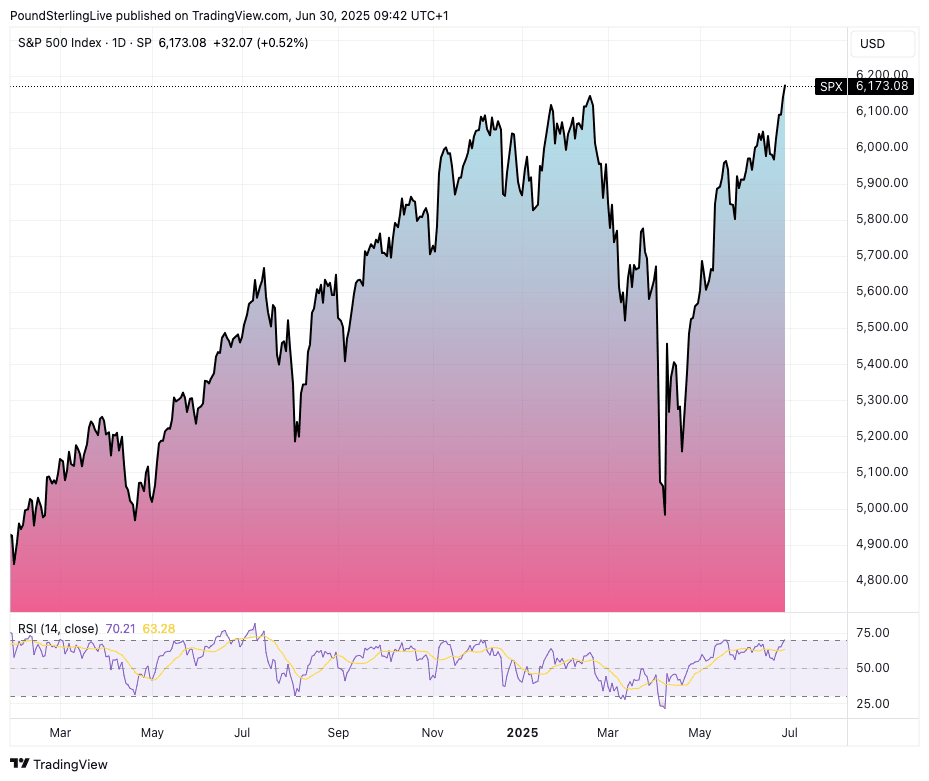

Above: The U.S. S&P 500 is near record highs.

The New Zealand Dollar is advancing on the Pound at the start of the new week on the back of rising global stock markets, to which it is particularly sensitive.

"U.S. equity markets have powered to fresh record highs, with the S&P 500 and Nasdaq leading the charge. The rally has reignited conversations about whether the “Buy America” trade is making a comeback. After months of concerns over geopolitical tensions, tariff risks, and economic headwinds, the tone has clearly shifted. Relief on multiple fronts, both macro and micro, has helped reset sentiment and drive risk appetite," says Charu Chanana, Chief Investment Strategist at Saxo Bank.

There are a number of drivers pushing markets higher, including signs of progress in U.S. trade negotiations, with a number of new deals expected to be inked ahead of the July 09 deadline imposed by U.S. President Donald Trump.

Also, the Fed is increasingly expected to cut interest rates again in the third quarter of the year, with some even speculating towards a July cut.

"Markets are pricing in a soft-landing scenario, where the Fed can ease without the economy falling into recession—offering a sweet spot for risk assets," says Chanana.

Given the NZ Dollar is considered a 'risk asset', it is only natural to see it advancing in this environment.

Image courtesy of ANZ.

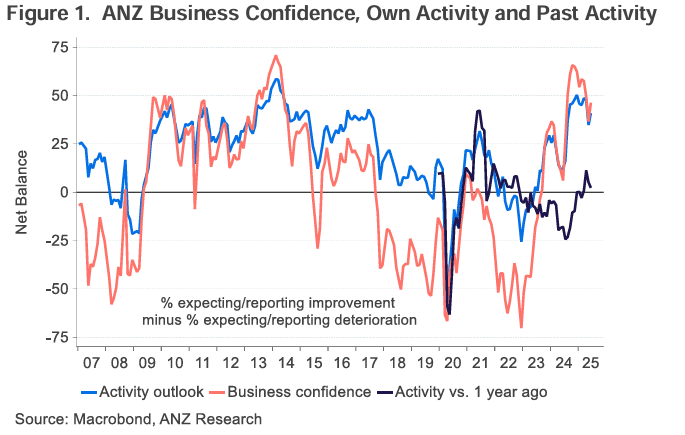

There was also some good news out of New Zealand at the start of the week, with ANZ's measure of domestic business confidence rising to 46.3% in June from 36.6%, representing an ongoing improvement in conditions.

Expected own activity rose 6 points to net 41%, as the global tariff turmoil faded, said ANZ.

Although conditions are improving, ANZ's analysis of their findings suggest firms continue to struggle.

Sharon Zollner, ANZ's chief economist, says it continues to be a difficult business environment for many.

"Costs are still going up and margins are being squeezed, with low turnover and a highly competitive environment making it very difficult to recoup margins. Dark clouds globally are impeding risk-taking, though we did see the rebound in many forward-looking activity indicators that was presaged by the intra-month data in May. But in terms of what firms are actually experiencing, there’s been a bit of a slump recently in both activity and employment," she explains.

Image courtesy of Westpac.

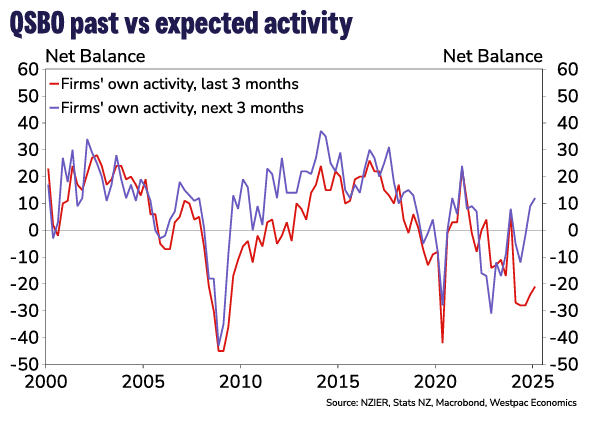

Looking ahead, July 01 brings with it the results of the much-watched NZIER Business Confidence survey for the second quarter.

"As an indicator of GDP, it’s actually the expectations that have been closer to the mark, so it will be interesting to see if that optimism has been sustained," says a note from Westpac ahead of its release.

"Some of the high-frequency activity data has softened again recently, and Trump’s tariff announcement in April has added another layer of uncertainty. Both the activity and inflation measures in the QSBO appear to have been quite influential on the RBNZ over the last year, and this week’s survey could again be key in determining their tone at the 9 July OCR review," it adds.

Should the RBNZ judge further rate cuts are necessary, the NZ Dollar can come under pressure, allowing GBP/NZD to melt up again.