Image © Adobe Images

A short-term trading model likes the look of the New Zealand Dollar at these levels.

Crédit Agricole currency strategists are looking for a higher New Zealand Dollar over short-term time frames after one of their in-house models triggered a buy following recent declines.

"NZD/USD’s fair value rose from 0.6067 to 0.6099 due to a rise in the NZ/U.S. short-term rates spread as well as falls in the NZ-U.S. box yield spread and agricultural commodity prices," says a note released Monday by Crédit Agricole.

Crédit Agricole's FAST FX model has identified three new trades this week: buying Euros vs the yen and the Dollar, as well as buying NZD/USD.

The model is up 5.88% over the past year with a hit rate of 59%.

"NZD/USD’s fall has made it more than 1.5 standard deviations undervalued. The FAST FX model has triggered a long NZD/USD trade," says Crédit Agricole.

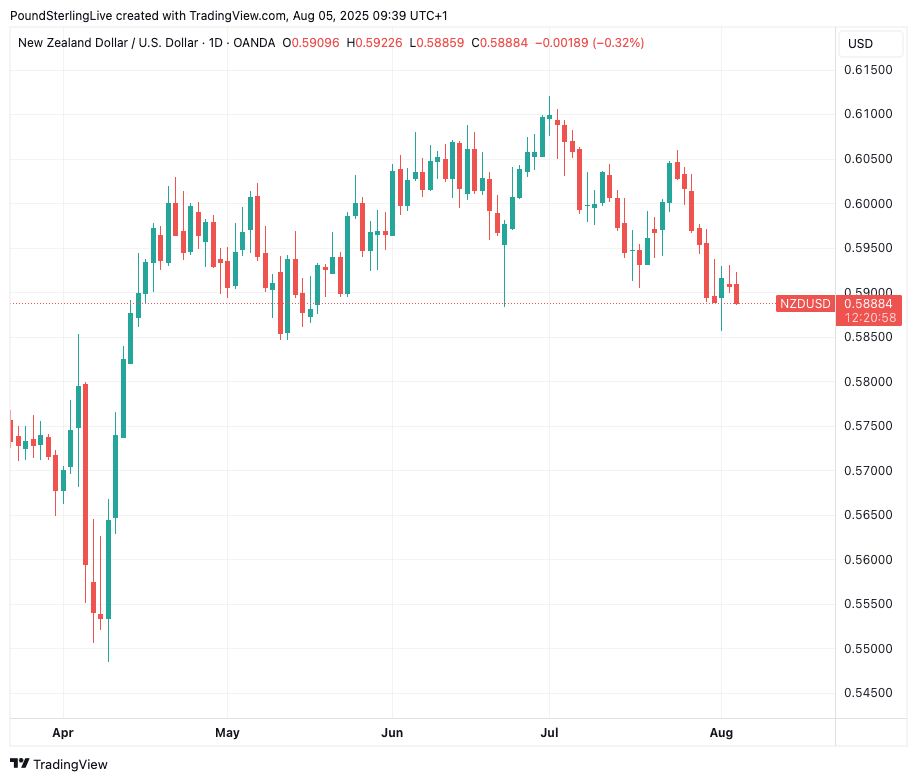

The New Zealand Dollar fell 1.67% against the U.S. Dollar last week and is now down at 0.5888 by the time of writing Tuesday. The FAST FX model looks for shifts in valuation over short-term timeframes, making it a contrarian model that would look to bet against short-term moves that are overextended.