Image © Adobe Images

The unwind of the powerful "carry trade" is having a material impact on NZ Dollar value say analysts.

The New Zealand Dollar is under noticeable pressure, with factors such as growing expectations for a Reserve Bank of New Zealand interest rate cut and dour sentiment towards China regularly cited for the declines.

But, there is another, potentially even more potent force at play: the unwind of the carry trade as the Japanese Yen recovers from multi-decade lows.

The Yen is surging as investors anticipate a potential rate rise at the Bank of Japan, which comes amidst talk of further currency intervention by the Bank. Demand for the Yen has also increased as investors bet on the prospect of interest rate cuts at the Federal Reserve.

It is no coincidence that the surge in the Yen corresponds with the dumping of the NZD, AUD, and other currencies.

"The carry unwind continues," says Max Lin, an economist at CIBC Capital Markets: "The weakness in carry currencies (AUD, NZD, SEK, NOK), and strength in the funders (JPY, CHF) has been the theme to start the session. Since the US inflation print came in weaker than anticipated (July 11th), USD/JPY has sold off over 4%."

The carry trade sees investors borrow money where interest rates are low and invest where they are high.

Because Japan has the lowest base rates in the G10, it is considered an attractive "funder". New Zealand has the highest base rate, so the attraction of borrowing from Yen-based lenders and buying New Zealand Dollar-based assets is highly attractive.

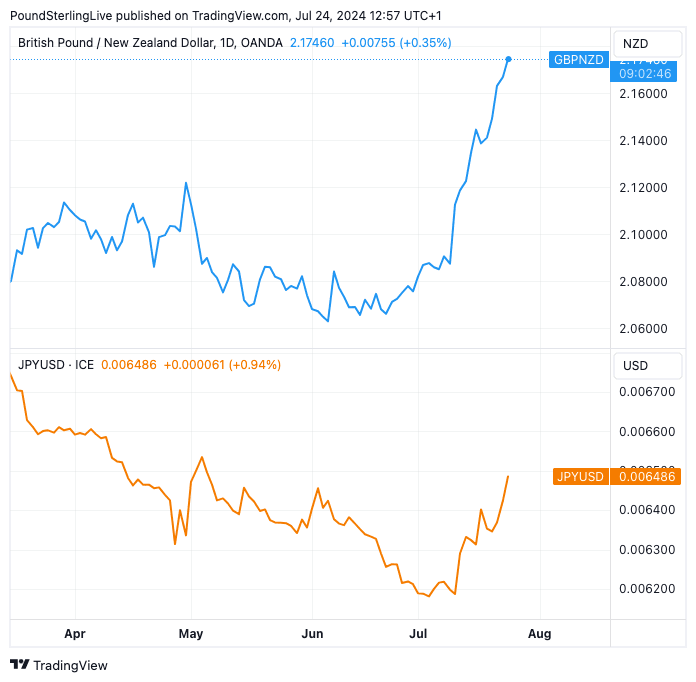

Above: GBP/NZD has surged higher as the Yen (lower panel) stages a comeback in July. Track GBP/NZD with your custom alerts; find out more here

This creates demand for the New Zealand Dollar. But when the trade reverses, the payback can be impressive.

According to Investopedia, the most popular carry trades have involved buying currency pairs like the AUD/JPY and NZD/JPY because their interest rate spreads have been quite high.

As 'carry' unwinds, weakness in NZD/JPY and AUD/JPY will have a mechanical impact on other NZD and AUD exchange rates. For instance, GBP/NZD and GBP/AUD are up 5.80% and 3.13% in July, respectively.

"Antipodean currencies continued weaken as cross-yen carry positions continued to see unwinds," says Lin.