Image © Adobe Stock

Headlines on Yuan weakness have pushed the NZ Dollar sharply lower.

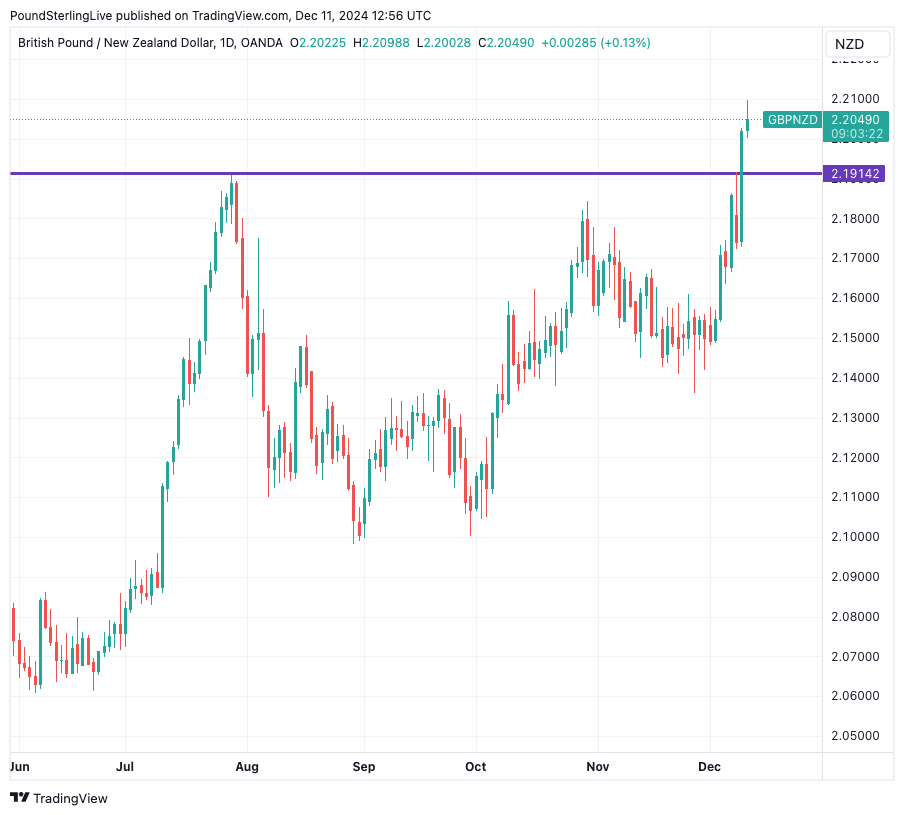

The Pound to New Zealand Dollar (GBP/NZD) exchange rate hit its highest level in 8 years and 11 months after Reuters reported the People's Bank of China (PBoC) was willing to let the yuan weaken.

The report said the central bank could switch from the current regime of tightly managing USD/CNY volatility to one where the yuan is more closely linked to a basket of currencies.

Another report said the PBoC had considered allowing USD/CNY to rise as high as 7.50 to counter trade shocks.

The Yuan is not a free-floating currency and is managed by the PBoC. However, economic realities often mean the central bank has to follow the market's path, and of late all forces are pushing towards a further weakening.

Max Lin, an analyst at CIBC Capital Markets, says the headlines are responsible for the renewed weakness in the New Zealand Dollar and its Australian counterpart.

The New Zealand and Australian Dollars trade as proxies to China owing to the importance of China as an export market for both Australia and New Zealand.

The two currencies are, as a result, often subject to a positive correlation with their Chinese counterpart.

This is why weakness in CNY translates into a softer NZD.

But it's not just China that is buffeting the New Zealand Dollar. Tuesday saw a significant selloff in NZD as it fell alongside the Australian Dollar, which was hit by indications the Reserve Bank of Australia (RBA) is now considering an interest rate cut as soon as February.

The recalibration in market expectations for Australian interest rates weighed on the AUD, and the NZD tracked its antipodean neighbour lower.

In short, we are seeing notable weakness in the Kiwi Dollar courtesy of developments in China and Australia.

The weakness has translated into the notable break higher in GBP/NZD to its highest level in nearly nine years at 2.2098.

The breakdown of resistance at 2.1914 was accomplished in a decisive fashion on Tuesday, and the follow-through momentum that such a break engenders is underway.

From a technical perspective, this opens the door to a run to 2015 highs at 2.4595 at some point in early 2025.