Image © Adobe Images

“Nearer-term factors, such as the growth outlook, also point to a weaker USD”

The U.S. dollar is poised for further weakness in the second half of 2025, according to Invesco’s latest midyear investment outlook note, as relative growth expectations narrow and investor confidence in U.S. policy stability continues to erode.

The asset manager points to a confluence of factors behind its bearish stance on the dollar, including slower U.S. growth, high fiscal deficits, and increased global diversification away from dollar-denominated assets.

"Foreign investors have been recycling surpluses into USD assets for well over a decade. That trend may be starting to reverse," says the research note.

After an exceptional 15-year run, analysts say the dollar appears "rich" on a trade-weighted basis. The Goldman Sachs real trade-weighted dollar index remains well above historical averages, suggesting limited upside without renewed macro strength.

But instead of strong growth, the U.S. is facing economic headwinds. Invesco notes that U.S. growth forecasts for 2025 have declined more than for any other major economy.

“Nearer-term factors, such as the growth outlook, also point to a weaker USD,” the report says, adding that disinflationary pressures in Europe and Asia may allow other central banks to cut rates sooner, creating a divergence in global policy that weakens the dollar further.

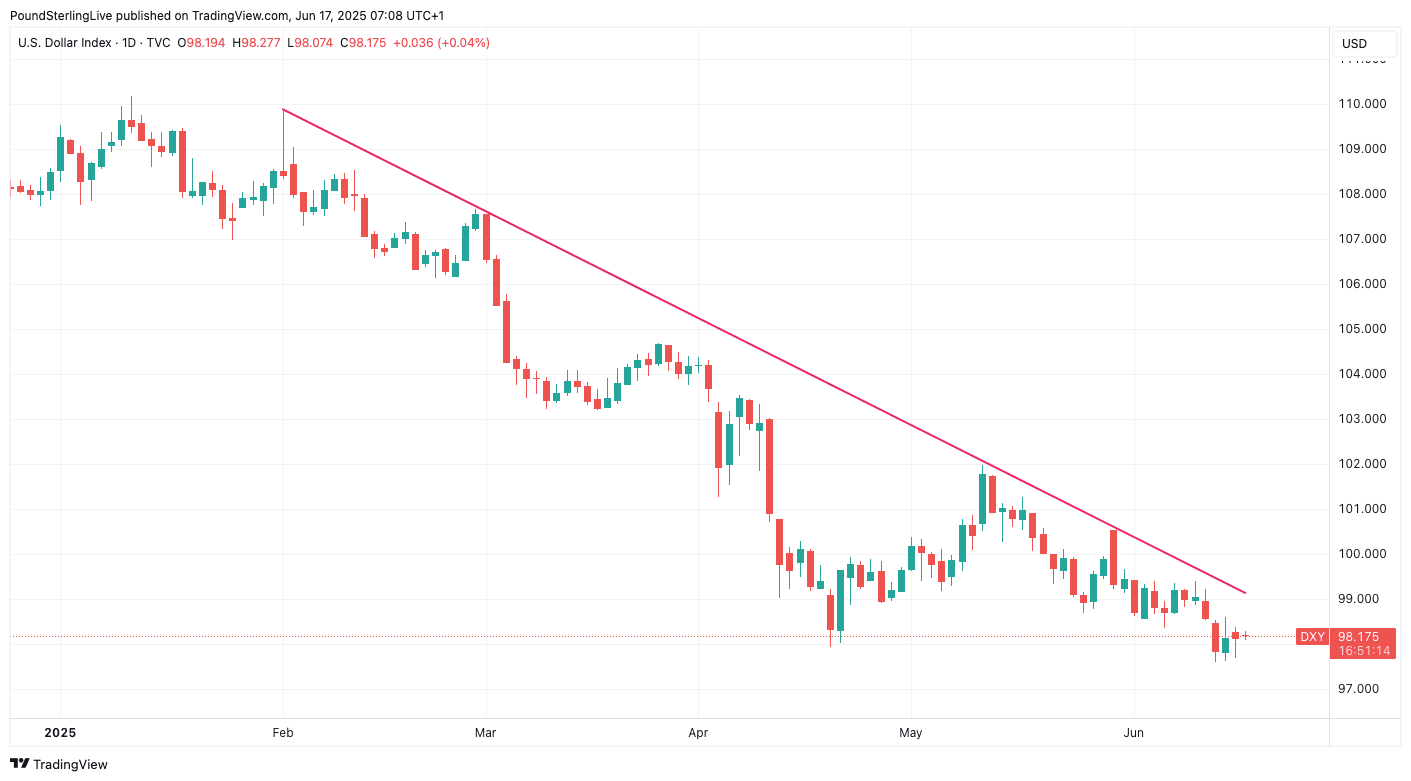

Above: The Dollar index at daily intervals.

Invesco is one of the world’s largest independent investment management firms, managing over $1.6 trillion in assets. Invesco’s research is closely watched by institutional investors, pension funds, sovereign wealth funds, and financial advisors, many of whom use its insights to shape asset allocation decisions.

Because of its non-bank, independent structure, Invesco is considered freer to express market-critical or contrarian views

Invesco warns that ongoing domestic policy volatility could drive foreign capital away from U.S. markets. As of early 2025, foreign investors hold over $32 trillion in U.S. financial assets. Any meaningful shift in that allocation could place additional downward pressure on the currency.

Moreover, there are signs that central banks are actively diversifying reserves.

Since 2022, strong gold buying by global central banks has signalled a strategic move to reduce dependence on the U.S. dollar, a trend that Invesco believes could accelerate if geopolitical tensions persist.

Turning to monetary policy, Invesco says that although the Federal Reserve remains cautious on rate cuts, the dollar might fail to benefit as the traditional link between rate differentials and the currency may no longer hold.

"The proximate cause of weaker growth in the U.S. is a perceived policy error," it states, implying that rate support for the dollar could be outweighed by structural concerns.

Invesco’s view aligns with its broader investment positioning, which favours major developed market currencies like the euro and British pound over the dollar, and recommends global bonds over U.S. Treasuries amid fiscal uncertainty.

With U.S. macro momentum waning and international investors increasingly sceptical of America's direction under President Donald Trump, the dollar’s long-standing dominance may be entering a new and weaker phase.