Image © Adobe Images

The highlight of the week approaches in the form of the U.S. labour market report, where a surprise outcome can shake up markets ahead of the weekend.

Ahead of the release, economists at Lloyds Bank say they anticipate an above-consensus 195k jobs gain after a weak report last month.

The market is expecting a print of 160K, up from July's hurricane-impacted 115K gain. The playbook says the Dollar will rise should these expectations be beaten as it lowers the odds of a 50 basis point rate cut at the Federal Reserve on September 18.

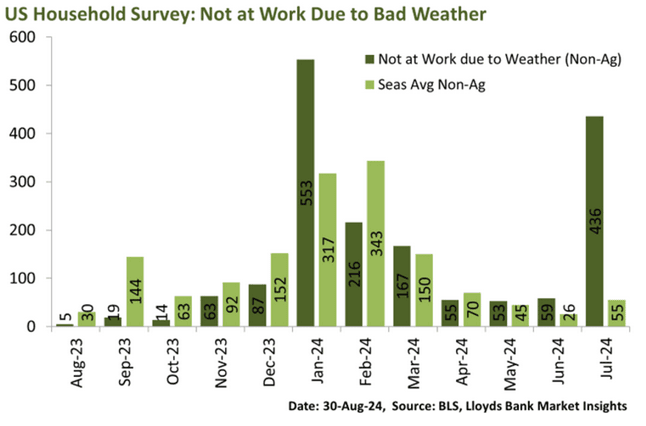

"Will last month’s disappointing 115k employment gain turn out to have been a weather-related blip or not?" asks Lloyds analyst Sam Hill. The weak data saw the Dollar sold widely, which helped the Pound-Dollar exchange rate break above 1.28 and commence a journey to 1.32.

Hurricane Beryl impacted some southern states in July and economists say this was reflected in the understrength hiring figures that were reported. "There was a large pool of workers who stepped out of the labour force last month that could return," says Hill.

Lloyds economists anticipate a headline employment gain of 195k and a dip back in the unemployment rate to 4.2%, taking into account some bounce back from temporary factors last month.

"After weak news on job openings and from the ADP report earlier in the week, an outturn in line with our expectations would be 30k above consensus and a serious challenge to market expectations of a roughly one-in-three chance of a 50bp cut from the Fed in September," says Hill.

"However, with some nervy sentiment in equities and a solid performance for bonds, it does also feel like many market participants will still be in the mood to attempt to find reasons to downplay the significance of modest upside surprises," he adds.

Ahead of the release, the Dollar index - a measure of broader dollar performance - is quoted at 100.85, down from 101.91 recorded on Tuesday.

The GBP/USD exchange rate has recovered to 1.3188 from 1.3087, EUR/USD is higher at 1.1118 having been as low as 1.1026 on Tuesday.