Image © Giuseppe Milo, CC BY 2.0. Source.

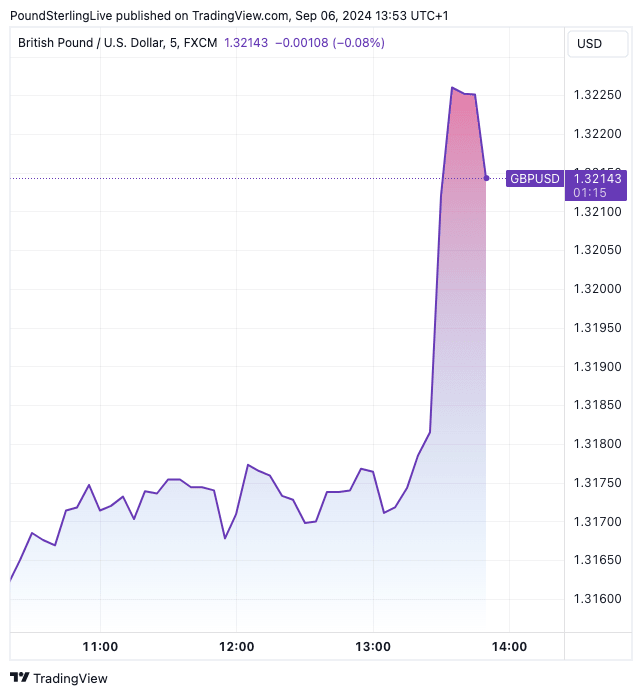

The Dollar fell and then recovered after the release of a softer-than-expected U.S. labour market report.

The Pound to Dollar exchange rate recovered to 1.3230 from 1.3170 after the headline nonfarm payrolls missed expectations of 160K after landing at 142k in August. The pair then retreated again to go sub-1.32, perhaps in part owing to a speech from the Federal Reserve's John Williams, that made no clear commitment to a 50bp rate cut later this month.

Williams said the time had come to cut rates, but market expectations for an outsized 50bp move faded as he showed no inclination for such a strong initial cut.

In addition, the undershoot in the headline non-farm payroll figure wasn't a massive miss and is still up on July's 114K. In addition, the unemployment rate fell to 4.2% from 4.3%, which was expected. Also shining on the USD-positive end of the spectrum was a stronger-than-expected earnings print of 0.44% month-on-month, which was stronger than an expected 0.3% print.

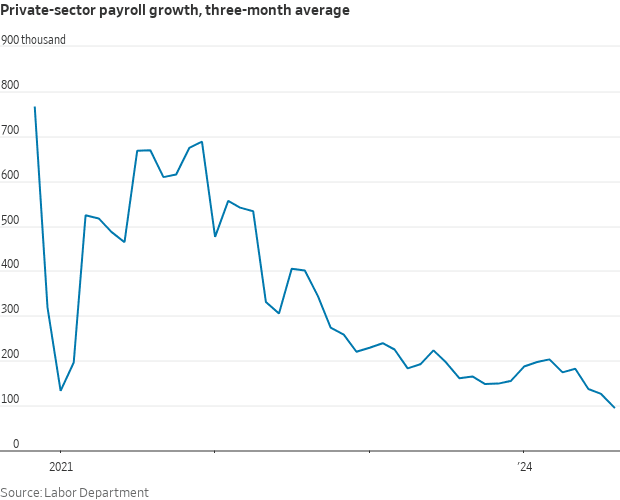

Hurricane Beryl is widely believed to have distorted the picture in July, which is why smoothing the data on a three-month rolling basis offers a good snapshot of how the labour market is trending.

The rolling three month average has now fallen to 116K from 146K, confirming a clear trend of weakening:

Image courtesy of @NickTimiraos

The Dollar's post-payroll reaction is likely to be constrained to recent ranges as there is not enough evidence in this report to clearly signal whether the Fed will go 50 or 25bp, ensuring an element of doubt remains.

"This report doesn't neatly resolve the tactical question, and the pricing is at 50-50," says Nick Timiraos, Chief economics correspondent at The Wall Street Journal.

Above: GBP/USD rallied following the data release.

Next week's inflation report will provide more guidance for markets, but it must be noted that the Fed has switched its focus from inflation to employment, believing price rises are ultimately set to fall further in the coming months.

The Fed will be worried that unemployment will rise if it does not act, but the debate now is how forceful the opening salvo should be.

"We strongly believe that the Fed must go big – and go big now," says Nigel Green, CEO of deVere Group. "The Fed has already waited too long to address mounting economic headwinds, and delaying further could have dire consequences for the US, and therefore global, economy."

The Fed is expected to cut rates by a total of 100 basis points this year, meaning at least one of the remaining meetings will see a rate cut of 50bp. If this is delivered, the USD can continue its descent as U.S. interest rates converge with those in other parts of the world.

"With US 10y Treasury yield's tendency to fall after first Fed cut, global financial conditions are set to loosen further. USD may see more weakness as other central banks, particularly the ones that cut policy rates ahead of the Fed, can now afford to let the Fed do some of their work," says an analysis from Bank of America.