Image: Official White House Photo by Adam Schultz.

The Dollar was sold after the U.S. reported a rise in the unemployment rate.

The Pound to Dollar exchange rate rallied to 1.28 after the U.S. unemployment rate rose to 4.2% in November from 4.1%, suggesting there is enough weakness in the labour market to justify another Federal Reserve rate cut later this month.

However, there were numerous constructive headlines from the labour market report: non-farm payrolls rose 227K in November, up from 36K and ahead of expectations of 200 K. The number was well within the range of forecasts and perhaps the USD bull run wanted something more impressive.

GBP/USD is now set to register a second consecutive weekly close as it forms a base that will provide a platform for further advances in December.

The Dollar rallied in October and November as U.S. economic data impressed and Donald Trump's victory was digested.

But the 'Trump trade' looks to have eaten its fill while the U.S. economic numbers need to jump an increasingly high hurdle to keep feeding the dollar bulls.

The Fed will look at these data and see nothing amiss that would put them off cutting interest rates again in December.

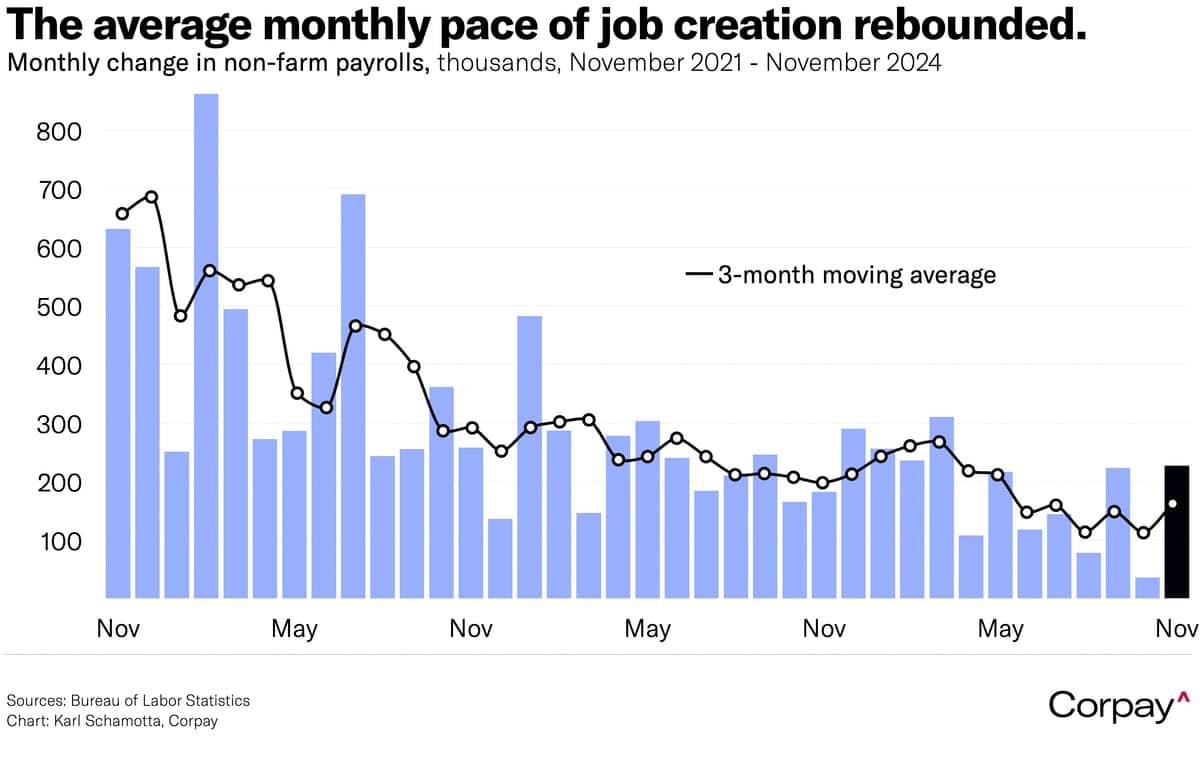

As the below chart shows, the rate of employment growth is well below its highs and 2024 has seen a particularly notable shift lower in the running three-month average:

However, the prospect of rate cuts in 2025 is greatly reduced compared to just three months ago. This is because the still robust labour market can continue to generate the wage increases required to keep inflation sticky.

The jobs report revealed that U.S. average hourly earnings rose 4% year over year in November, unchanged from October, but ahead of consensus expectations for a slide to 3.9%.

The market only anticipates about two to three Fed rate cuts in 2025, which is a relatively low expectation. For this number to fall yet further would require a determined pick up in the economy.

Trump might deliver this in 2025 with tax cuts and other supply-side reforms. He might also boost inflation via import tariffs.

However, these are unknowns at this stage and it won't be until January until we get a clearer picture on policy for 2025.

The risks remain tilted toward fewer rate cuts at this stage, which can keep the Dollar supported and limit the upside of GBP/USD in the new year.